Biden’s Policies Lead to Largest Increase in Health Insurance Premiums in Nearly 10 Years

September 19, 2023 | by Kaju

Health insurance premiums are anticipated to experience a sharp increase in 2024, despite President Biden’s claims of cost containment. This surge is primarily driven by a surge in medical claims and demands from hospitals for higher payments from insurers after facing elevated labor and supply costs, as noted by analysts in the healthcare industry.

The rising costs can be attributed to the expensive specialty drugs and the growing utilization of popular weight-loss medications such as Ozempic. The estimated rate increases for employer-based plans range between 6% and 7%, according to WTW (formerly known as Willis Towers Watson).

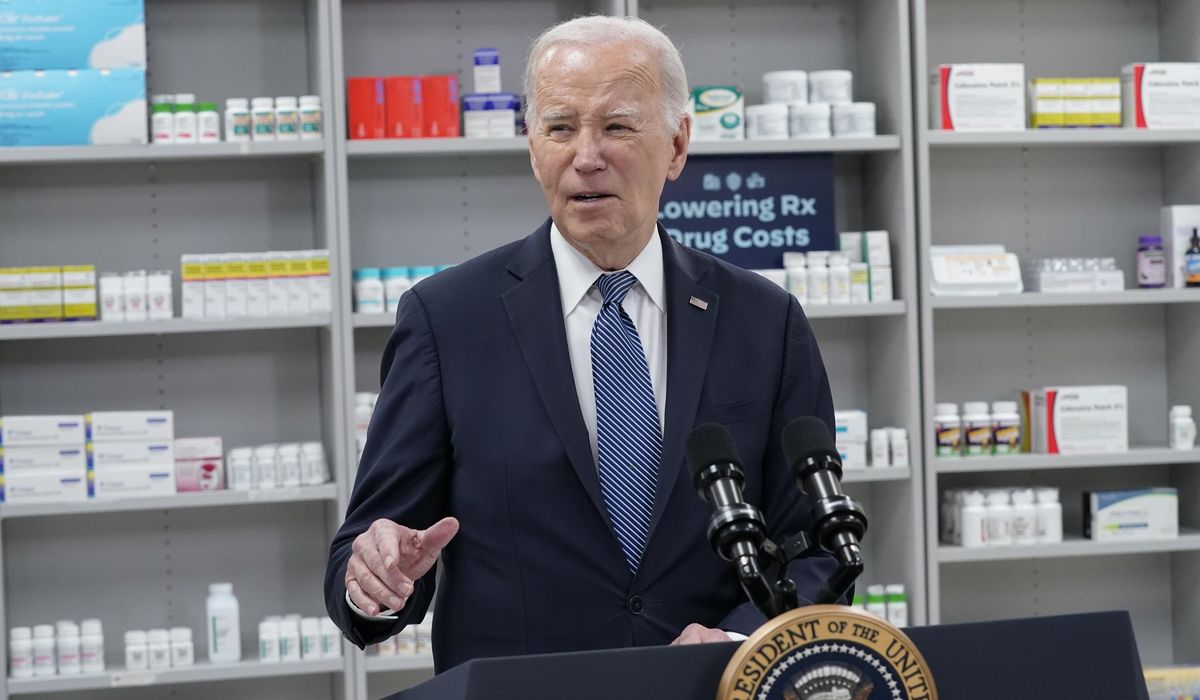

Alan Silver, senior director and financial analytics leader at WTW, stated that there is a general consensus that costs in 2024 will exceed those of the past decade. This increase poses a vulnerability for President Biden, who is campaigning for reelection on the promise of reining in inflation and confronting large pharmaceutical companies by initiating price negotiations for ten drugs under Medicare.

Cathy McMorris Rodgers, Chairwoman of the House Energy and Commerce Committee, criticized President Biden’s policies, stating that although he claims one thing, his actions tell a different story. The increase in healthcare costs is contrary to President Biden’s goals and initiatives.

The rise in health insurance premiums is occurring parallel to an increased usage of medical services. During the pandemic, individuals postponed medical procedures and doctor visits due to public health recommendations. Now, medical claims have returned to pre-pandemic levels, putting additional pressure on insurers.

Aon, a health benefits consultancy, estimates that the average costs for US employers providing health coverage for their employees will rise by 8.5% to over $15,000 per employee in 2024. However, this estimate does not account for potential cost-saving strategies or employers transferring more costs onto their employees. With these adjustments, Aon predicts a 6.5% to 7.5% increase in average healthcare costs for employers in 2024, compared to a 4.5% increase seen in 2023 after implementing plan changes to save money.

While employers typically subsidize around 80% of the plan cost, many may be reluctant to impose additional costs on their workers, potentially obscuring the burden for everyday employees.

Federal subsidies will serve as a protective measure against the higher rates in the Obamacare marketplace, offering assistance to consumers who use the program to find health plans on federally operated websites or state-managed portals.

KFF (formerly Kaiser Family Foundation) analysts expect a median proposed premium increase of 6% among 320 insurers participating in the Obamacare marketplace across 50 states and the District of Columbia. A more thorough analysis of 58 insurers identified the growth in healthcare prices as a significant factor contributing to the 2024 cost increase.

Additionally, changes in pandemic-related costs and the termination of Medicaid continuous coverage have affected premiums, although to a lesser extent. Approximately 18.2 million individuals purchase health insurance in the individual market, with nearly 14.3 million of them receiving federal subsidies.

Republicans have criticized the increasing subsidies, arguing that directing taxpayer money towards rising healthcare costs is wasteful. Democrats, on the other hand, have made these subsidies more generous in recent years.

The Biden-Harris Administration emphasizes its commitment to expanding access to health insurance and lowering healthcare costs. The Centers for Medicare and Medicaid Services stated that the 2024 rates in the Obamacare exchange will likely remain highly affordable for consumers, comparable to the rates in 2023.

In light of rising costs, policymakers in Washington may consider expanding access to health savings accounts and other tax-exempt payment methods. Employers will ultimately face pressure to determine whether to pass on costs to employees through increased payroll deductions or higher deductibles.

The adjustments made by employers may result in benefit structure reconfigurations that require employees to meet certain requirements to receive care. Healthcare plans may impose new hurdles, such as prior authorization and limits on coverage.

As the open enrollment approaches, employees are advised to carefully evaluate the coverage and costs of the different plans available to them.

RELATED POSTS

View all