The Painful Impact of High Interest Rates on Bakers, Farmers and Consumers

October 23, 2023 | by Kaju

Home buyers, entrepreneurs, and public officials are facing a new reality as they wait for borrowing to become less expensive. The increase in interest rates has had a widespread impact on various sectors of the economy.

Governments are now paying more to borrow money for projects such as schools and parks. Developers are finding it difficult to obtain loans to purchase land and build homes. Companies, especially those with low or no profits, are being forced to refinance their debts at higher interest rates, potentially leading to layoffs.

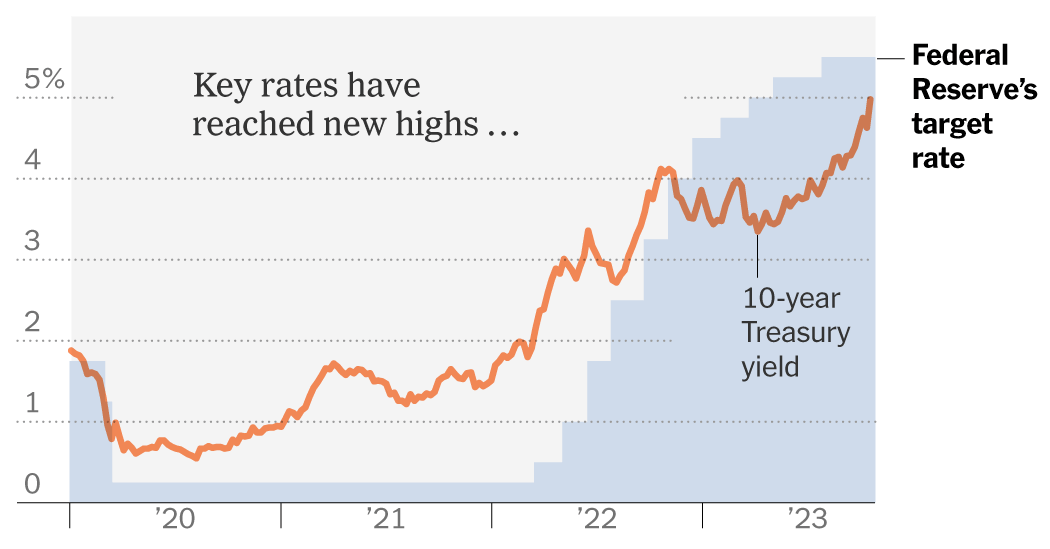

While the Federal Reserve may be ending its increases in short-term interest rates, long-term borrowing costs continue to rise. This suggests that the economy may be heading towards a sharper slowdown that cannot be avoided.

The impact of high interest rates is felt by everyone, as explained by Mary Kay Bates, the CEO of Bank Midwest in Spirit Lake, Iowa. Small banks like Bank Midwest are at the epicenter of America’s credit crunch for small businesses.

During the pandemic, small banks could offer loans at lower interest rates due to the Fed’s benchmark rate being near zero. However, when the Fed’s rate started increasing, the value of their securities portfolio fell, making it not feasible to sell the bonds to fund more loans without taking a significant loss.

As a result, small banks like Bank Midwest are borrowing money from the Fed and other banks, which is more expensive. They are also paying higher interest rates on deposits. These factors have led to small banks charging borrowers higher rates and being more cautious about who they lend to.

The impact of high interest rates extends to small businesses like Liz Field’s bakery, the Cheesecakery, in Cincinnati. Field borrowed money to open a cafe, but as interest rates increased, her monthly loan payments also rose dramatically, affecting her ability to expand her business and impacting her employees.

According to analysts, interest payments for small businesses are projected to rise next year. This puts additional strain on businesses that rely on bank loans for growth and development. It is particularly challenging for new businesses that lack the resources to weather the high cost of capital.

Agriculture is another sector experiencing the painful impact of high interest rates. Falling commodity prices have depressed farm income, while high borrowing costs make purchasing new equipment more expensive for farmers.

The real estate industry is also feeling the effects of high interest rates. Residential construction activity has declined as interest rates suppress home sales. Builders who secured financing before rates increased are now offering discounts to sell or lease units. The scarcity of capital may result in a lack of affordable housing options in the future.

Consumers, despite running through their pandemic-era savings, continue to spend. However, as the pace of pay increases slows, consumer spending may change. Car dealerships, for example, have been raising prices due to low inventory. The average interest rate on new auto loans has reached its highest level since the early 2000s, impacting car sales.

Overall, the era of high interest rates is challenging for those who need to borrow for day-to-day needs. Rising housing costs and stagnant wage growth further exacerbate the financial strain on consumers. While some individuals can minimize financing costs by paying with cash, others face difficult financial situations.

The painful impact of high interest rates is evident across various industries and affects everyone from small business owners to consumers. Finding ways to alleviate this burden is crucial for economic stability and growth.

RELATED POSTS

View all