The Bankruptcy of WeWork Could Further Weaken the Struggling New York Office Market

November 4, 2023 | by Kaju

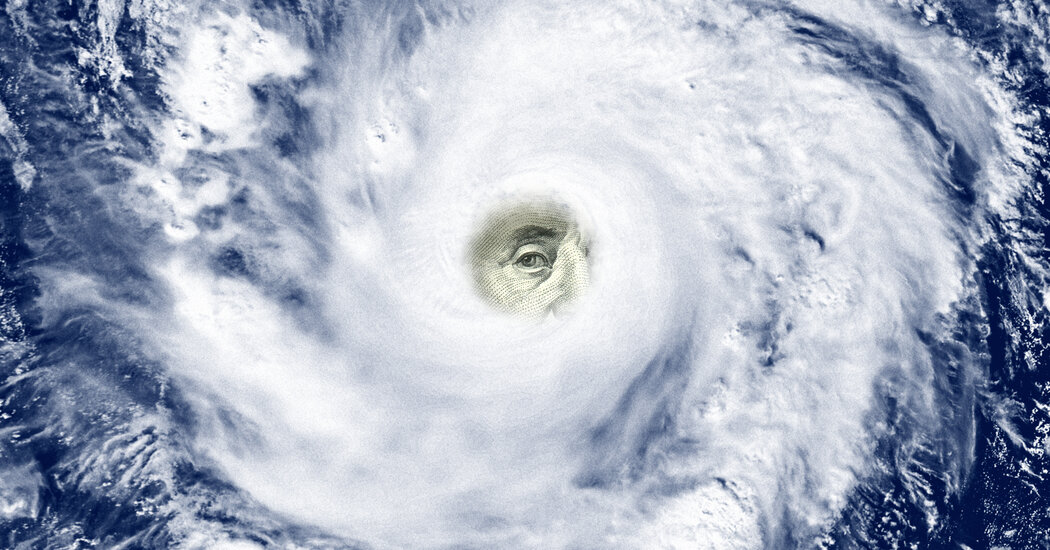

For years, WeWork was a highly sought-after tenant for landlords around the world, making it the largest corporate tenant in New York and London. However, with the pandemic causing a decrease in office occupancy, the struggling co-working company is now on the brink of bankruptcy. This couldn’t have come at a worse time for office landlords who are already facing one of the worst crunches in commercial real estate in decades.

Many landlords have already accepted lower rents from WeWork in order to keep the company afloat. However, if WeWork goes bankrupt, it would be a significant blow for these landlords, particularly those who have leased a large portion of their space to the company. Landlords may have to fight in court to recover anything from the bankruptcy proceedings.

In New York City, where office vacancy rates are at their highest in decades, the impact of a WeWork bankruptcy would be felt the most in older office buildings in Midtown and downtown Manhattan. These buildings, classified as Class B and Class C, would likely see a significant decline in value, making it even more difficult for landlords to meet their debt obligations.

The fallout from a WeWork bankruptcy would be seen in various office buildings across New York, such as the Empire State Building and 980 Avenue of the Americas, where WeWork leases a substantial amount of space. Landlords who have already been struggling to receive rent payments from WeWork may be forced to consider alternative options for their vacant spaces, such as converting them into residences.

It’s clear that a WeWork bankruptcy will have a significant impact on the New York office market, with the value of Class B and Class C buildings potentially decreasing by 55%. This will further exacerbate the challenges faced by landlords who have already seen a decline in office building valuations.

Despite its previous valuation of $47 billion and its status as a pioneer in the co-working industry, WeWork’s business model was always precarious. Its inability to generate enough revenue to cover its operating costs ultimately led to its downfall. WeWork’s bankruptcy filing will undoubtedly reshape the landscape of the commercial real estate market, particularly in New York.

While some landlords may be able to find alternative co-working tenants or repurpose their spaces, the revenue generated from these arrangements is unlikely to match what they were receiving from WeWork. Ultimately, the bankruptcy of WeWork serves as a cautionary tale for landlords and investors who were once bullish on the company’s prospects.

As the future of WeWork remains uncertain, the New York office market will face further challenges in the wake of this potential bankruptcy. Landlords will need to find creative solutions to fill their vacant spaces and adapt to the changing demands of the post-pandemic workplace.

Focus Keyword: WeWork bankruptcy, New York office market

RELATED POSTS

View all