December 11, 2023 | by Kaju

WASHINGTON (AP) — With inflation edging nearer to the Federal Reserve‘s 2% goal, its policymakers are going through — and in some instances fueling — hopes that they may make a decisive shift in coverage and lower rates of interest subsequent 12 months, presumably as quickly as spring.

Such a transfer would cut back borrowing prices throughout the economic system, making mortgages, auto loans and enterprise borrowing inexpensive. Inventory costs might rise, too, although share costs have already risen in expectation of cuts, probably limiting any additional rise.

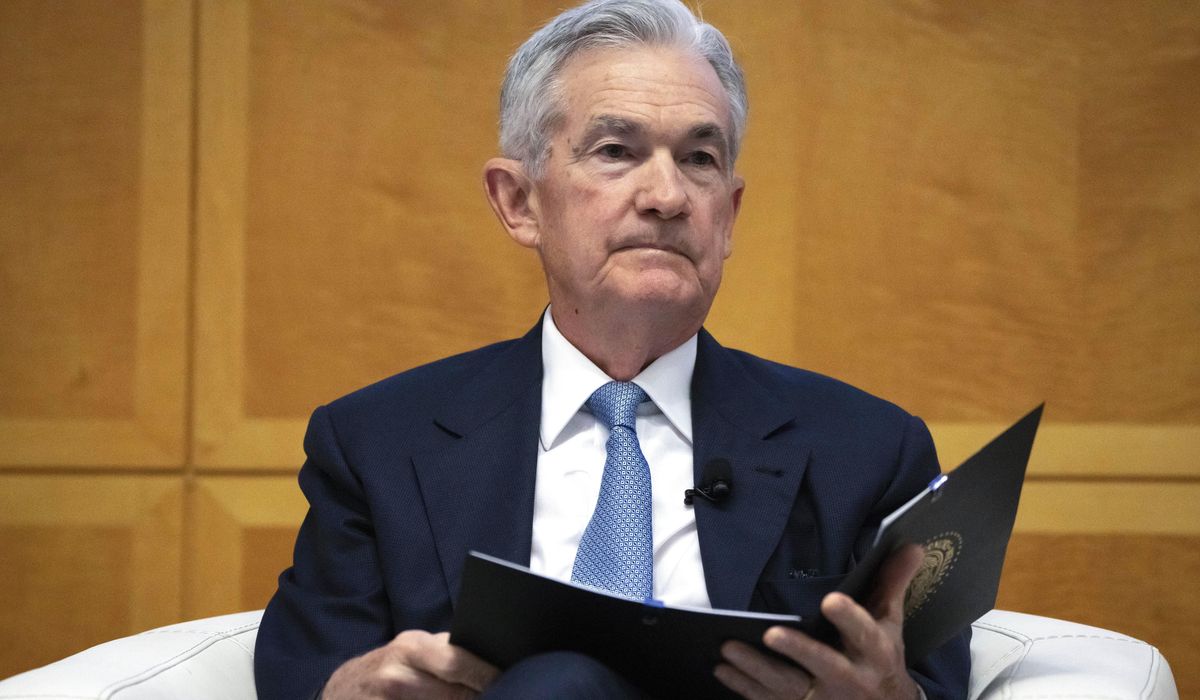

Fed Chair Jerome Powell, although, has lately downplayed the concept price reductions are nearing. With the central financial institution poised to maintain its key short-term price unchanged when it meets this week, Powell hasn’t but signaled that the Fed is conclusively executed with its hikes. Talking lately at Spelman Faculty in Atlanta, the Fed chair cautioned that “it could be untimely to conclude with confidence” that the Fed has raised its benchmark price excessive sufficient to completely defeat inflation.

However the Fed‘s two-day assembly that ends Wednesday will mark the third straight time that its officers have saved their key price unchanged, lending weight to the widespread assumption that price hikes are over.

The economic system, in spite of everything, is headed within the course the Fed desires: On Tuesday, when the federal government releases the November inflation report, it’s anticipated to indicate that annual shopper worth will increase slowed to three.1%, based on a survey of economists by FactSet, down sharply from a peak of 9.1% in June 2022.

And job openings have declined, which suggests corporations are much less determined to rent and really feel much less stress to sharply elevate wages, which may speed up inflation. Shoppers are nonetheless spending, although extra modestly, and the economic system remains to be increasing.

Such traits counsel progress towards what economists name a “smooth touchdown,” by which inflation reaches the Fed‘s 2% goal with out inflicting a recession. Analysts are more and more inspired by what they are saying is an unusually clean adjustment to decrease inflation.

That sunnier outlook represents a shift in considering. Final 12 months, many economists had insisted that defeating inflation would require a pointy recession and excessive unemployment. The truth is, falling inflation, with out an accompanying recession or job losses, is “traditionally unprecedented,” economists at Goldman Sachs wrote in a current observe.

Austan Goolsbee, president of the Federal Reserve Financial institution of Chicago, mentioned in an interview with The Related Press final month that america is on monitor this 12 months for the quickest annual drop in inflation on document. If that’s the case, Goolsbee mentioned, the consequence might be a “larger smooth touchdown than standard knowledge believes has ever been potential.”

That mentioned, a smooth touchdown is hardly a positive factor. If, for instance, the Fed miscalculated and saved rates of interest too excessive for too lengthy, it might finally derail the economic system and tip it right into a recession.

“There’s extra danger of a recession than a re-acceleration in inflation at these rates of interest,” mentioned Julia Coronado, president of MarcoPolicy Views, an financial analysis agency. “So finally, the following transfer is prone to be a lower due to that.”

The timing of any price cuts will rely on the well being of the economic system. A recession – or the specter of one – would possible immediate extra, and earlier, rate of interest reductions by the Fed.

But Friday’s jobs report for November confirmed that companies are nonetheless including jobs at a wholesome tempo, and the unemployment price dropped to a low 3.7% from 3.9%. Such figures steered that the most-anticipated recession in many years is just not imminent. Traders have since pushed again their expectations for the primary Fed price lower from March to Might.

The Fed might lower charges this 12 months even when the economic system plows forward, so long as inflation saved falling. A gradual slowdown in worth will increase would have the impact of elevating inflation-adjusted rates of interest, thereby making borrowing prices greater than the Fed intends. Decreasing charges, on this state of affairs, would merely hold inflation-adjusted borrowing prices from rising.

But economists say any price cuts in response to decrease inflation could take longer than Wall Avenue expects as a result of the Fed will need to make sure inflation is in test earlier than making such a transfer.

Jim Bullard, former president of the Federal Reserve Financial institution of St. Louis and now dean of Purdue College’s enterprise faculty, mentioned that whereas he thinks the Fed is on monitor for a smooth touchdown, the policymakers should be cautious about price cuts.

“I don’t assume you need to be too early on that, as a result of when you begin the method of slicing the coverage price after which inflation goes again up, I believe that might trigger a number of issues,” Bullard mentioned. Such untimely cuts have been blamed for the Fed‘s failure to quell inflation within the Seventies.

And if job positive aspects and financial development stay wholesome, then maybe price cuts aren’t wanted anytime quickly, Bullard added.

“Why decrease the coverage price if the true economic system is doing simply effective?” he requested. “You would possibly as nicely simply sit again and benefit from the disinflation.”

Both means, when the Fed points its quarterly financial projections Wednesday, they may embrace a forecast of the place its policymakers assume their key price shall be on the finish of 2024. Coronado expects solely two price cuts to be penciled in – half the quantity that monetary markets now count on.

If the Fed does lower charges twice in 2024, the primary one could not happen till as late as fall. Nancy Vanden Houten, lead U.S. economist at Oxford Economics, says her agency doesn’t count on the primary price lower till the third quarter of the 12 months.

RELATED POSTS

View all