January 3, 2024 | by Kaju

Costs climbed quickly in 2021 and 2022, straining American family budgets and chipping away at President Biden’s approval score. However inflation cooled in late 2023, a spurt of progress that occurred extra rapidly than economists had anticipated and that stoked hopes of a delicate financial touchdown.

Now, the query is whether or not the excellent news can persist into 2024.

As forecasters attempt to guess what is going to occur subsequent, many are trying intently at the place the current slowdown has come from. The main points recommend {that a} mixture of weaker items costs — issues like attire and used vehicles — and moderating prices for companies together with journey has helped to drive the cooldown, whilst hire will increase take time to fade.

Taken collectively, the tendencies recommend that extra disinflation could possibly be in retailer, however in addition they trace that a number of lingering dangers loom. Beneath is a rundown of the massive adjustments to look at.

What we’re speaking about once we speak about disinflation.

What’s taking place in America proper now could be what economists name “disinflation”: Once you examine costs right this moment with costs a yr in the past, the tempo of improve has slowed notably. At their peak in the summertime of 2022, client costs had been growing at a 9.1 % yearly tempo. As of November, it was simply 3.1 %.

Nonetheless, disinflation doesn’t imply that costs are falling outright. Value ranges have typically not reversed the massive run-up that occurred simply after the pandemic. Which means issues like rent, car repairs and groceries stay costlier on paper than they had been in 2019. (Wages have additionally been climbing, and have picked up extra rapidly than costs in current months.) Briefly, costs are nonetheless climbing, simply not as rapidly.

What inflation fee are officers aiming for?

The Federal Reserve, which is answerable for making an attempt to revive worth stability, needs to return worth will increase to a sluggish and regular tempo that’s in line with a sustainable economic system over time. Like different central banks around the globe, the Fed defines that as a 2 % annual inflation fee.

What triggered the 2023 disinflation shock?

Inflation shocked economists in 2021 and 2022 by first capturing up sharply after which remaining elevated. However beginning in mid-2023, it started to swing in the wrong way, falling quicker than extensively predicted.

As of the center of final yr, Fed officials expected a key measure of inflation — the Private Consumption Expenditures measure — to finish the yr at 3.2 %. As of the most recent information launched in November, it had as a substitute pale to a extra modest 2.6 %. The extra well timed Shopper Value Index measure has additionally been coming down swiftly.

The surprisingly fast cooldown began as journey costs started to decelerate, mentioned Omair Sharif, founding father of Inflation Insights. When it got here to airfares specifically, the story was provide.

Demand was nonetheless robust, however after years of restricted capability, obtainable flights and seats had lastly caught up. That mixed with cheaper jet gas to ship fares decrease. And whereas different travel-related service costs like resort room charges jumped quickly in 2022, they had been growing far more slowly by mid-2023.

The subsequent change that lowered inflation came from goods costs. After leaping for 2 years, costs for merchandise like furniture, apparel and used vehicles started to climb far more slowly — and even to fall.

The quantity of disinflation coming from items was shocking, mentioned Matthew Luzzetti, chief U.S. economist at Deutsche Financial institution. And, encouragingly, “it was moderately broad-based.”

The inflation aid got here partly from provide enhancements. For years, snarled transit routes, costly transport fares and a restricted provide of employees had restricted what number of services firms might supply. However by late final yr, transport routes had been operating normally, pilots and flight crews had been within the skies, and automotive firms had been churning out new autos.

“The provision aspect is at work,” mentioned Skanda Amarnath, government director on the worker-focused analysis group Make use of America.

What could possibly be the subsequent shoe to drop?

In truth, one supply of long-awaited disinflation has but to point out up totally: a slowdown in rental inflation.

Private-sector data tracking new rents soared early within the pandemic however then slowed sharply. Many economists assume that pullback will ultimately feed into official inflation information as renters renew their leases or begin new ones — however the course of is taking time.

“We’re more likely to see extra moderation in hire,” mentioned Laura Rosner-Warburton, senior economist and founding associate at MacroPolicy Views.

As a result of an even bigger hire cooldown stays attainable and items worth will increase might hold slowing, many economists count on general client worth inflation to fall nearer to the Fed’s aim by the tip of 2024. There may be even a threat that it might slip beneath 2 %, some assume.

“It’s a situation that deserves some dialogue,” Ms. Rosner-Warburton mentioned. “I don’t assume it’s the almost definitely situation, however the dangers are extra balanced.”

What might go incorrect?

In fact, that doesn’t imply Fed officers and the American economic system are solely out of the woods. Falling gas prices have been serving to to tug inflation decrease each general and by feeding into different costs, like airfares. However gas costs are notoriously fickle. If unrest in gas-producing areas causes power prices to leap unexpectedly, stamping inflation out will develop into tougher.

Geopolitics additionally carry one other inflation threat: Assaults in opposition to service provider ships within the Crimson Sea are messing with a key transit route for international commerce, for example. If such issues final and worsen, they might ultimately feed into greater costs for items.

And maybe essentially the most instant threat is that the massive inflation slowdown towards the tip of 2023 might have been overstated. Lately, end-of-year worth figures have been revised up and January inflation information have are available in on the nice and cozy aspect, partly as a result of some firms elevate costs at the start of the brand new yr.

“There’s a bunch of choppiness coming,” Mr. Sharif mentioned. He mentioned he’ll intently watch a set of inflation recalculations slated for launch on Feb. 9, which ought to give policymakers a clearer view of whether or not the current slowdown has been as notable because it appears to be like.

However Mr. Sharif mentioned the general takeaway was that inflation appeared poised to proceed its moderation.

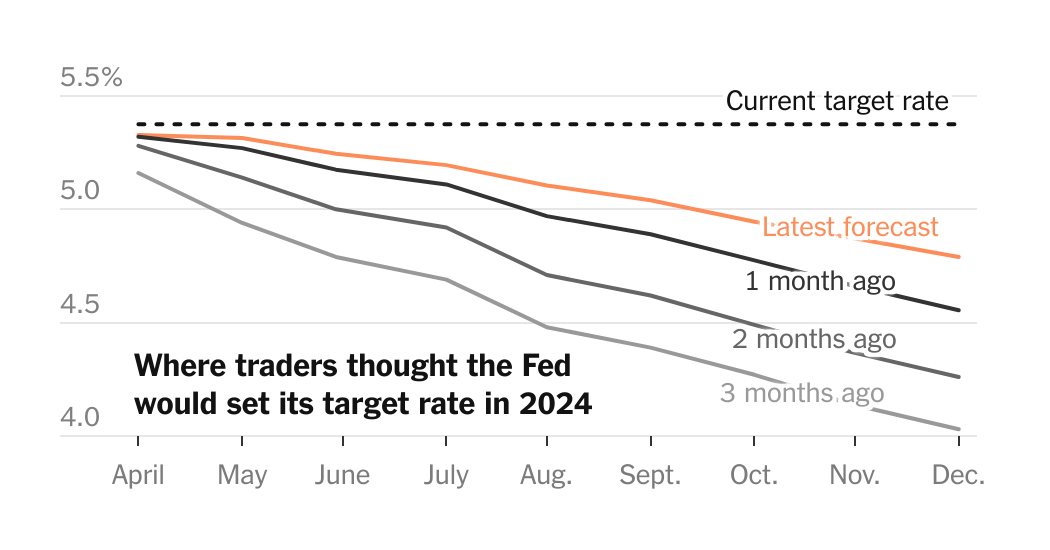

That might assist to pave the trail for decrease rates of interest from the Fed, which has projected that it might decrease borrowing prices a number of occasions in 2024 after elevating them to the very best stage in additional than 22 years in a bid to chill the economic system and wrestle inflation below management.

“There’s not a variety of upside threat left, in my thoughts,” Mr. Sharif mentioned.

RELATED POSTS

View all