January 6, 2024 | by Kaju

The U.S. labor market ended 2023 with a bang, gaining extra jobs than specialists had anticipated and buoying hopes that the financial system can settle right into a stable, sustainable stage of development moderately than fall right into a recession.

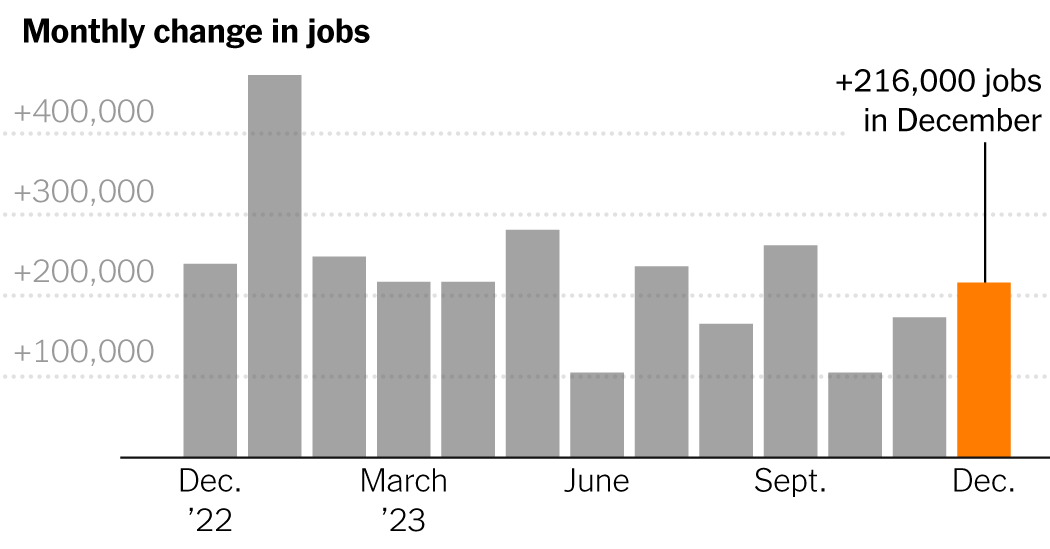

Employers added 216,000 jobs in December on a seasonally adjusted foundation, the Labor Division reported on Friday. The unemployment fee was unchanged at 3.7 p.c.

Though hiring has slowed in current months, layoffs stay close to file lows. The sturdiness of each hiring and wage good points is all of the extra exceptional in mild of the Federal Reserve’s aggressive collection of rate of interest will increase previously couple of years. However a spread of analysts warns that the coast isn’t but clear and says the results of these increased charges will take time to filter via enterprise exercise.

“The actual take a look at for the labor market begins now, and up to now it’s passing the take a look at,” mentioned Daniel Altman, the chief economist at Instawork, a digital platform that connects employers with job seekers.

Monetary commentary previously 12 months has been dominated by dueling narratives in regards to the financial system. Most economists warned that the Fed’s driving up borrowing prices at a traditionally fast tempo would ship the financial system right into a downturn. Heading into 2023, over 90 p.c of chief executives surveyed by the Convention Board mentioned they have been anticipating a recession. And lots of main analysts thought that value will increase may soften provided that staff skilled vital job losses.

However the resilience of the overall economy and client spending has up to now defied that outlook: In June 2022, inflation was roughly 9 p.c. Inflation has since tumbled to three p.c whereas the unemployment fee has been largely unmoved.

Altogether, the U.S. financial system added roughly 2.7 million jobs over the previous 12 months. That’s a smaller acquire than in 2021 or 2022. But the 2023 improve was bigger than these within the late 2010s and represented the fifth strongest 12 months for job development since 2000.

Nonetheless, the report included hints that the touchdown could but be bumpy.

Providers like well being care, social help work, and state and native governments led the way in which in December job good points, however beforehand scorching sectors comparable to transportation and warehousing both misplaced jobs or edged upward solely modestly.

The general labor drive — the ranks of these at present working or in search of work — shrank by nearly 700,000 staff, in response to the December knowledge. That was unwelcome information after regular labor drive development throughout a lot of 2023.

As well as, figures for October and November have been revised down by 71,000. That left common month-to-month job improve within the final quarter of 2023 at about 165,000 — down from about 221,000 within the third quarter and 201,000 within the second quarter.

Omair Sharif, the founding father of the info analytics agency Inflation Insights, mentioned in a be aware to subscribers that the December quantity represented “a wholesome acquire,” however added that “hiring has clearly cooled.”

Heading into an election 12 months, the employment image additionally has a political dimension.

President Biden, whose dealing with of the financial system has drawn low rankings in voter surveys, heralded the December numbers. “Robust job creation continued whilst inflation fell,” he mentioned in a press release, whereas noting that costs stay a priority for a lot of within the nation.

The intently watched College of Michigan Client Sentiment Index was decrease in December than it has been 83 p.c of the time since 1978, a interval that has included shocks and slumps that, on paper, look worse than the current. The index climbed for a lot of final 12 months, nevertheless, and several other elements could have contributed to sunnier perceptions.

After almost two years throughout which inflation was outstripping wage good points, that stability has shifted in current months. Common hourly earnings for staff rose 0.4 p.c in December from the earlier month and have been up 4.1 p.c from December 2022.

The housing market, frozen by increased rates of interest, is a supply of frustration for aspirational first-time residence patrons. However for many who personal their properties — roughly two-thirds of American households — the common fee on all excellent mortgage debt is a mere 3.7 p.c, shielding them from increased shelter prices.

Although many households have struggled since 2021, falling again towards poverty because the community of federal help related to the pandemic response pale, the share of household disposable income going to debt payments is beneath its prepandemic stage, an indication of stable total client well being.

Annie Wharton, a 56-year-old artwork advisor in Los Angeles, is a beneficiary of the monetary stability that many middle-class and extra prosperous People have been in a position to handle regardless of the vertigo of the 2020s.

Artwork is a enterprise that “has all the time had challenges,” Ms. Wharton mentioned. “However I’m blissful to say this has been 12 months.”

Her workplace acquired a mortgage from the Commerce Division beneath the Paycheck Safety Program, a key part of the federal government’s pandemic aid effort, which allowed her to maintain her small workers absolutely employed all through.

Issues have slowed “with an unsure financial outlook,” she added, saying “individuals appear extra cautious than regular” and “everyone seems to be considering twice earlier than shopping for.” However she stays optimistic.

As soon as once more, the most important uncertainties could come from overseas.

In 2022, simply as world provide chain disruptions have been easing, the Russian invasion of Ukraine prompted oil and a variety of meals and vitality commodities to soar, typically doubling or extra in value, driving additional inflation.

Final 12 months largely supplied a lull in new disruptions. However conflagrations within the Center East have broadened since fall, threatening key worldwide commerce routes. Maersk, the goliath firm in worldwide transport, has introduced that for the foreseeable future it can hold container ships away from the Crimson Sea, the place drone and missile assaults in opposition to service provider ships have picked up in current weeks.

In consequence, the price to ship items from Asia to northern Europe has surged by roughly 170 percent since December, in response to analysts at Bloomberg who monitor world commerce. Oil and fuel costs, which have eased considerably for the reason that early phases of the conflict in Ukraine, have been principally unaffected by the newest turmoil, however extra extended disruptions could possibly be felt by American customers within the type of increased costs for vitality and items.

Kathy Bostjancic, chief economist on the insurance coverage big Nationwide, tasks that the financial system will expertise at the very least a reasonable recession this 12 months, with unemployment rising to five p.c.

However analysts on the optimistic facet of the home financial debate are largely sticking to their view.

Joseph Brusuelas, the chief economist at RSM, a consulting agency, expects that inflation will proceed to ease, “which is able to bolster home family stability sheets and increase consumption within the 12 months forward.”

Artwork Papas, the chief government of Bullhorn, a software program supplier for staffing and recruitment businesses, says “there may be numerous pent-up demand” amongst his prospects — midsize and enormous corporations — as they anxiously anticipate a inexperienced mild on additional hiring and funding.

“It seems like we’re on this bizarre state of stability,” he mentioned, “which I’ve by no means seen earlier than.”

Santul Nerkar contributed reporting.

RELATED POSTS

View all