February 15, 2024 | by Kaju

The pandemic created an financial disaster not like any recession on file. So maybe it shouldn’t be stunning that the aftermath, too, has performed out in a approach that nearly no economists anticipated.

When unemployment soared within the first weeks of the pandemic, many feared a repeat of the lengthy, gradual rebound from the Nice Recession: years of joblessness that left many employees completely scarred. As an alternative, the restoration within the labor market has been, by many measures, the strongest on file.

In early 2021, some economists foresaw a surge in inflation. Others have been skeptical: Comparable predictions in recent times — in some circumstances from the identical forecasters — had failed to return true. This time, nevertheless, they have been proper.

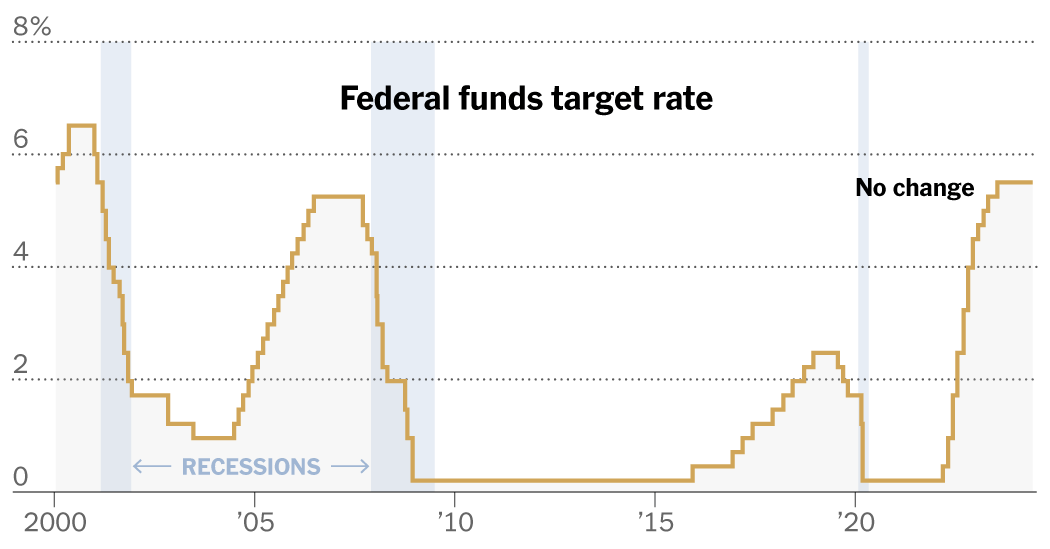

And when the Federal Reserve started making an attempt to tamp down inflation, there have been warnings that the job market was certain to buckle, because it had threatened to do each time policymakers started elevating rates of interest too quickly within the decade earlier than the pandemic. As an alternative, the central financial institution has raised charges to their highest degree in many years, and the job market is holding regular, or even perhaps gaining steam.

The ultimate chapter on the restoration has not been written. A “smooth touchdown” just isn’t a achieved deal. However it’s clear that the financial system, notably the job market, has proved much more resilient than most individuals thought possible.

Interviews with dozens of economists — a few of whom acquired the restoration partly proper, a lot of whom acquired it principally unsuitable — offered insights into what they’ve discovered from the previous two years, and what they make of the job market proper now. They didn’t agree on all the small print, however three broad themes emerged.

1. This time actually was totally different.

Economists have discovered to be cautious of concluding that “this time is different.” Irrespective of how totally different the specifics, the fundamental legal guidelines of financial gravity have a tendency to carry fixed: Bubbles burst; money owed come due; patterns of hiring and firing evolve in methods which might be broadly, if imperfectly, predictable.

However the pandemic recession actually was totally different. It wasn’t brought on by some elementary imbalance within the financial system, just like the dot-com bubble within the early 2000s or the subprime mortgage growth a couple of years later. It was brought on by a pandemic that compelled many industries to close down just about in a single day.

The response was totally different, too. By no means had the federal authorities offered a lot assist to so many households and companies. Regardless of mass unemployment, private incomes rose in 2020.

The end result was a restoration that was quick however chaotic. When vaccines enabled folks to enterprise out once more, they’d cash to spend, however companies weren’t able to allow them to spend it. That they had shed tens of millions of employees, a few of whom had moved on to different cities or industries, or had began companies of their very own, or who weren’t obtainable to work as a result of colleges remained closed or the well being dangers nonetheless appeared too nice. Corporations needed to navigate provide chains that remained snarled lengthy after every day life had returned principally to regular, they usually needed to alter their enterprise fashions to schedules, spending patterns and habits that had shifted in the course of the pandemic.

Looking back, it appears apparent that ordinary financial guidelines may not apply in such an surroundings. Ordinarily, for instance, when job openings fall, unemployment rises — with fewer alternatives obtainable, it’s tougher to search out work. However popping out of the pandemic shutdowns, even after the preliminary hiring rush slowed, there have been nonetheless extra vacancies than employees to fill them. And firms have been keen to carry on to the workers they’d labored so laborious to rent, so layoffs remained low even when demand started to chill.

Some economists did acknowledge that the pandemic financial system was more likely to observe totally different guidelines. Christopher J. Waller, a Fed governor, argued in 2022 that job openings could fall with out essentially driving up unemployment, for instance. However many different economists have been gradual to acknowledge the methods during which commonplace fashions didn’t apply to the pandemic financial system.

“It’s the hazard of forecasting what’s going to occur in excessive occasions from linear relationships estimated in regular occasions,” stated Laurence M. Ball, a Johns Hopkins economist. “We should always have identified that.”

2. The job market is returning to regular — and regular is fairly good.

The job market doesn’t look so unusual anymore. In actual fact, it appears largely because it did simply earlier than the pandemic started. Job openings are a bit greater than in 2019; job turnover is a bit decrease; the unemployment fee is nearly the identical.

The excellent news is that 2019 was a traditionally robust labor market, marked by positive aspects that lower throughout racial and socioeconomic strains. The 2024 model is, by some measures, even stronger. The hole in unemployment between Black and white People is close to a file low. Job alternatives have improved for folks with disabilities, felony information and low ranges of formal schooling. Wages are rising for all earnings teams and, now that inflation has cooled, are outpacing worth will increase.

“Regular” appears a bit totally different 5 years later, in fact. The pandemic drove tens of millions of individuals into early retirement, and lots of haven’t returned to work. The persistence of distant and hybrid work has harm demand for some companies, like dry cleaners, and shifted demand for others, like weekday lunch spots, from cities to the suburbs.

However whereas these patterns will proceed to evolve, the interval of frantic rehiring and reallocation is essentially over. Employees are nonetheless altering jobs, however they’re now not strolling out the door on their lunch break to take a better-paying alternative down the road. Employers nonetheless complain that it’s laborious to rent, however they’re now not providing signing bonuses and double-digit pay will increase to get folks within the door.

In consequence, many financial guidelines that went out the window earlier within the restoration could once more be related. With out such an extra of unfilled jobs, for instance, an extra decline in openings could actually augur a rise in unemployment. That doesn’t imply the previous fashions will carry out completely, however they could once more bear watching.

“You may simply think about that we had a interval the place, man, numerous bizarre issues occurred, however now we’re coming again to a world we perceive,” stated Man Berger, director of financial analysis on the Burning Glass Institute, a labor market analysis group.

3. The nice occasions don’t have to finish (essentially).

A number of years after the tip of the Nice Recession, many economists started warning that america would quickly run out of employees.

Employment had surpassed its pre-recession peak. The unemployment fee was approaching 5 %, a degree many economists related to full employment. Thousands and thousands of individuals had deserted the labor drive in the course of the recession, and it was unclear what number of needed jobs, or may get one in the event that they tried. The nonpartisan Congressional Funds Workplace estimated in early 2015 that job progress would quickly gradual to a trickle, simply sufficient to maintain up with inhabitants progress.

These projections proved wildly pessimistic. U.S. employers added greater than 11 million jobs from the tip of 2014 to the tip of 2019, tens of millions greater than what the funds workplace had anticipated. Corporations employed job seekers they’d lengthy shunned, pushing the unemployment fee to a 50-year low, and raised wages to draw folks off the sidelines. Additionally they discovered methods to make employees extra productive, permitting companies to continue to grow with out including as many staff.

It’s doable that if the pandemic hadn’t occurred, the job progress of the previous years would ultimately have petered out. However there may be little proof that was an imminent prospect in 2020, and there’s no cause it has to occur in 2024.

“A robust labor market units off a virtuous cycle, the place folks have jobs, they purchase stuff, firms do properly, they rent extra folks,” stated Julia Pollak, chief economist for the job website ZipRecruiter. “It takes one thing to gradual that practice and interrupt that cycle.”

Some type of interruption is feasible. The Fed, nervous about inflation, may wait too lengthy to start out slicing rates of interest and trigger a recession in spite of everything. And up to date information could have overstated the job market’s energy — economists level to numerous indicators that cracks could possibly be forming beneath the floor.

However pessimists have been citing comparable cracks for properly over a yr. Up to now, the inspiration has held.

RELATED POSTS

View all