April 9, 2024 | by Kaju

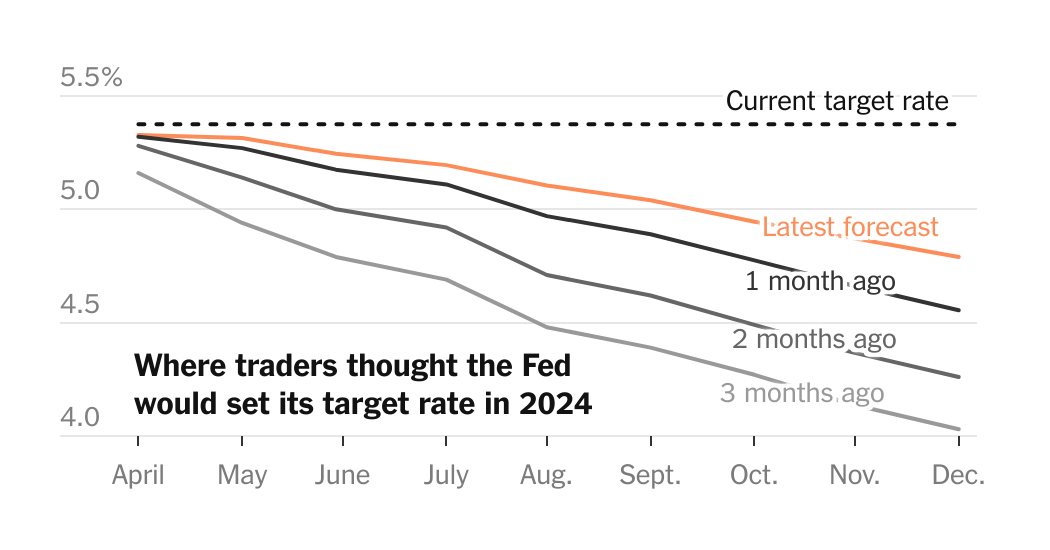

Traders had been betting large on Federal Reserve price cuts initially of 2024, wagering that central bankers would decrease rates of interest to round 4 p.c by the top of the yr. However after months of cussed inflation and powerful financial progress, the outlook is beginning to look a lot much less dramatic.

Market pricing now means that charges will finish the yr within the neighborhood of 4.75 p.c. That may imply Fed officers had minimize charges two or thrice from their present 5.3 p.c.

Policymakers try to strike a fragile stability as they ponder how to answer the financial second. Central bankers don’t need to danger tanking the job market and inflicting a recession by preserving rates of interest too excessive for too lengthy. However additionally they need to keep away from slicing borrowing prices too early or an excessive amount of, which might prod the economic system to re-accelerate and inflation to take even firmer root. To date, officers have maintained their forecast for 2024 price cuts whereas making it clear that they’re in no hurry to decrease them.

Right here’s what policymakers are as they give thought to what to do with rates of interest, how the incoming information may reshape the trail forward, and what that may imply for markets and the economic system.

What ‘increased for longer’ means.

When individuals say they anticipate charges to be “increased for longer,” they typically imply one or each of two issues. Typically, the phrase refers back to the close to time period: The Fed may take longer to begin slicing borrowing prices and proceed with these reductions extra slowly this yr. Different instances, it implies that rates of interest will stay notably increased within the years to return than was regular within the decade main as much as the 2020 pandemic.

Relating to 2024, high Fed officers have been very clear that they’re primarily targeted on what is occurring with inflation as they debate when to decrease rates of interest. If policymakers consider that worth will increase are going to return to their 2 p.c objective, they may really feel snug slicing even in a robust economic system.

Relating to the long run, Fed officers are more likely to be extra influenced by components like labor power progress and productiveness. If the economic system has extra momentum than it used to, maybe as a result of authorities infrastructure funding and new applied sciences like synthetic intelligence are kicking progress into increased gear, it could be the case that charges want to remain somewhat bit increased to maintain the economic system working on an excellent keel.

In an economic system with sustained vigor, the rock-bottom rates of interest that prevailed throughout the 2010s may show too low. To make use of the economics time period, the “impartial” price setting that neither heats up nor cools down the economic system could be increased than it was earlier than Covid.

For 2024, sticky inflation is the priority.

Just a few Fed officers have argued lately that rates of interest might stay increased this yr than the central financial institution’s forecasts have urged.

Policymakers projected in March that they had been nonetheless more likely to decrease borrowing prices thrice in 2024. However Neel Kashkari, the president of the Federal Reserve Financial institution of Minneapolis, suggested during a virtual event final week that he might think about a state of affairs wherein the Fed didn’t decrease rates of interest in any respect this yr. And Raphael Bostic, the Atlanta Fed president, said he didn’t foresee a rate cut till November or December.

The warning comes after inflation — which got here down steadily all through 2023 — has moved sideways in latest months. And with new strains surfacing, together with a pickup in fuel costs, delicate stress on supply chains after a bridge collapse in Baltimore and housing worth pressures which might be taking longer than anticipated to fade from official information, there’s a danger that the stagnation might proceed.

Nonetheless, many economists assume that it’s too early to stress about inflation’s stalling out. Whereas worth will increase had been faster in January and February than many economists had anticipated, that might have owed partly to seasonal quirks, and it got here after significant progress.

The Shopper Value Index inflation measure, which is ready for launch on Wednesday, is predicted to chill to three.7 p.c in March after risky meals and gas prices are stripped out. That’s down from an annual studying of three.8 p.c in February and much beneath a 9.1 p.c peak in 2022.

“Our view is that inflation will not be getting caught,” stated Laura Rosner-Warburton, senior economist at MacroPolicy Views. “Some areas are sticky, however I feel they’re remoted.”

The latest inflation information don’t “materially change the general image,” Jerome H. Powell, the Fed chair, stated throughout a speech last week, at the same time as he signaled that the Fed could be affected person earlier than slicing charges.

The longer run can also be in focus.

Some economists — and, more and more, buyers — assume that rates of interest might keep increased in coming years than Fed officers have predicted. Central bankers forecast in March that charges will likely be down to three.1 p.c by the top of 2026, and a pair of.6 p.c within the longer run.

William Dudley, a former president of the Federal Reserve Financial institution of New York, is amongst those that assume that charges might stay extra elevated. He famous that the economic system had been increasing rapidly regardless of excessive charges, suggesting that it could possibly deal with increased borrowing prices.

“If financial coverage is as tight as Chair Powell is arguing, then why is the economic system nonetheless rising at a fast tempo?” Mr. Dudley stated.

And Jamie Dimon, the chief govt of JPMorgan Chase, wrote in a shareholder letter this week that large societal adjustments — together with the inexperienced transition, provide chain restructuring, rising health-care prices and elevated navy spending in response to geopolitical tensions — might “result in stickier inflation and better charges than markets anticipate.”

He stated the financial institution was ready for “a really broad vary of rates of interest, from 2 p.c to eight p.c or much more.”

Borrowing could be pricier.

If the Fed does depart rates of interest increased this yr and in years to return, it’s going to imply that the cheap mortgage rates like those who prevailed within the 2010s are usually not coming again. Likewise, bank card charges and different borrowing prices would almost definitely stay increased.

So long as inflation will not be caught, that might be a very good signal: Superlow charges had been an emergency software that the Fed was utilizing to attempt to revive a flailing economic system. In the event that they don’t come again as a result of progress has extra momentum, that might be a testomony to a extra sturdy economic system.

However for would-be householders or entrepreneurs who’ve been ready for the price of borrowing to return down, that might present restricted consolation.

“If we’re speaking about rates of interest which might be increased for longer than shoppers had been anticipating, I feel shoppers could be disenchanted,” stated Ernie Tedeschi, a analysis scholar at Yale Regulation College who lately left the White Home’s Council of Financial Advisers.

RELATED POSTS

View all