April 16, 2024 | by Kaju

One other month, one other burst of better-than-expected job beneficial properties.

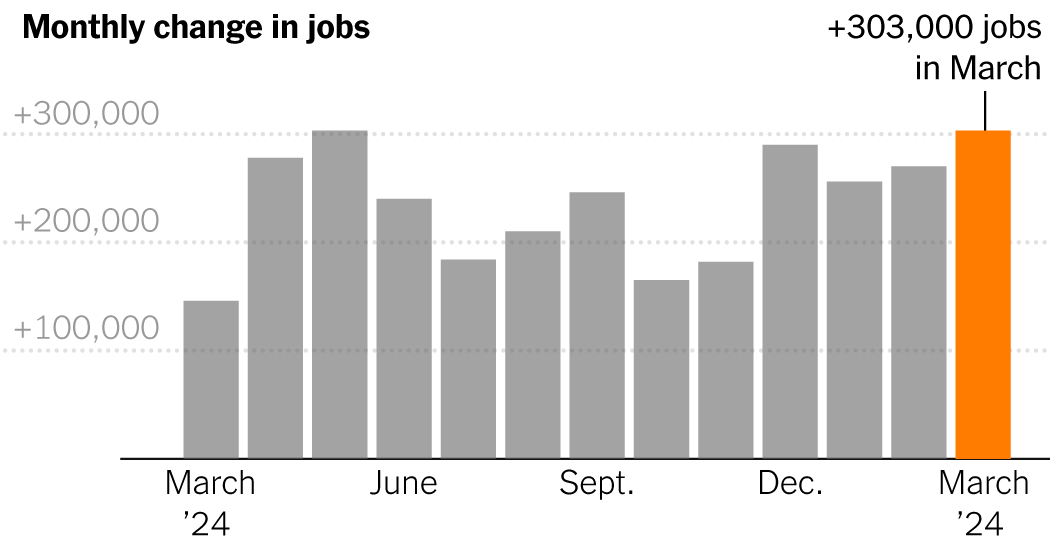

Employers added 303,000 jobs in March on a seasonally adjusted foundation, the Labor Division reported on Friday, and the unemployment fee fell to three.8 %, from 3.9 % in February. Expectations of a recession amongst consultants, as soon as widespread, at the moment are more and more uncommon.

It was the thirty ninth straight month of job progress. And employment ranges at the moment are greater than three million larger than forecast by the nonpartisan Congressional Price range Workplace simply earlier than the pandemic shock.

The resilient knowledge usually elevated confidence amongst economists and market traders that the U.S. economic system has reached a wholesome equilibrium through which a gentle roll of business exercise, rising employment and rising wages can coexist, regardless of the excessive rate of interest ranges of the final two years.

From late 2021 to early 2023, inflation was outstripping wage beneficial properties, however that additionally now seems to have firmly shifted, at the same time as wage will increase decelerate from their roaring charges of progress in 2022. Common hourly earnings for staff rose 0.3 % in March from the earlier month and have been up 4.1 % from March 2023.

“The vanishingly few areas to criticize this labor market are melting away,” mentioned Andrew Flowers, the chief labor economist at Appcast, a recruitment promoting agency.

Some have fearful that because the booming labor market restoration gave method to a milder enlargement, job progress would largely slender to much less cyclical sectors like authorities hiring and well being care. Good points in well being care — together with hospitals, nursing and residential care services and outpatient companies — led the best way on this report. However job progress, for now, stays broad-based.

The personal sector added 232,000 jobs general. Development added 39,000 jobs in March, about twice its common month-to-month achieve up to now yr. Employment in hospitality and leisure, which plunged through the pandemic, continues to bounce back and is now above its February 2020 ranges.

The “continued vigor,” mentioned Joe Davis, the worldwide chief economist at Vanguard, has come from “family steadiness sheets bolstered by pandemic-related fiscal coverage and a virtuous cycle the place job progress, wages and consumption gas each other.”

President Biden declared the report a “milestone,” noting that the economic system has created 15 million jobs since he took workplace and commenced a set of applications meant to spice up progress. “We’ve come a great distance, however I received’t cease combating for hard-working households,” he mentioned in an announcement.

Knowledge analysts word that better-than-expected beneficial properties in enterprise productiveness and work power participation have added gas, too. Current knowledge from the Bureau of Financial Evaluation reveals company income at a report excessive.

Officers on the Fed, which quickly raised rates of interest in 2022 and early 2023 to fight inflation, have expressed cautious optimism that they’re approaching their objectives of low unemployment and extra steady costs.

Inflation has fallen drastically from its peak of seven.1 %, according to the Fed’s preferred measure. However it ticked up in February to 2.5 %, nonetheless a half-percentage level away from the Fed’s goal. And a few fear that rising oil costs or geopolitical chaos might upend the fragile state of affairs.

Causes for warning transcend world occasions.

Man Berger, director of financial analysis on the Burning Glass Institute, which research the labor market, famous that although layoff charges are close to report lows, different knowledge on hiring was “according to an unemployment fee just below 5 %” primarily based on previous enterprise cycles.

And a few labor economists consider that elevated borrowing prices for customers and companies, which have been steered increased by the Fed, are poised to crack sure components of the economic system the longer companies must dwell with them.

Nancy Vanden Houten, lead U.S. economist on the advisory agency Oxford Economics, mentioned that the sturdy job progress needn’t deter the Fed from decreasing rates of interest — one thing it’s projected to do 3 times this yr — and including a layer of insurance coverage to the continuing enterprise enlargement.

“The Fed doesn’t must see a weak labor market to start chopping charges however will likely be guided by readings on wage progress and inflation, which we anticipate to point out extra progress towards the central financial institution’s aims within the subsequent few months,” she wrote in a analysis word.

Whilst narratives concerning the U.S. economic system amongst prime consultants have waffled between jubilant aid and cussed concern that the perfect of this enterprise cycle was completed, within the mixture the labor market has persistently been vibrant since 2022; nearly uneventfully so.

However the underlying particulars do present insights into potential shifts which will have an effect on the combo of hiring and business exercise going ahead.

Employment progress in sectors like skilled and enterprise companies, finance and data stays delicate. Daniel Zhao, the lead economist on the profession website Glassdoor, identified that these three sectors collectively added simply 10,000 jobs in March — a recent indication of how white-collar employers have grown far more choosy since their hiring spree through the pandemic.

“Corporations are hiring selectively, prioritizing high quality over amount,” mentioned Tom Gimbel, the chief govt of the LaSalle Community, a Chicago-based staffing and recruiting agency.

The upside is that these staff are the probably to be excessive earners within the first place; householders with low-cost, fixed-rate mortgages shielding them from rental inflation, and traders whose portfolios have been on an eye-popping bull run since fall.

Decrease-wage earners, for his or her half, are experiencing a job market much less scorching than a few years in the past, when switching jobs in quest of higher pay and advantages incessantly garnered double-digit % raises. The market is, nonetheless, nonetheless offering alternatives for earnings growth not seen since the late 1990s, according to key Fed measures.

In an interview with Bloomberg in March, Liz Everett Krisberg, the top of the Financial institution of America Institute, famous an important overarching actuality for households: The month-to-month median worth of financial savings and checking balances is greater than 40 % increased than in 2019 for all earnings ranges tracked by the financial institution.

Delinquencies are on the rise for subprime debtors of automobiles and bank cards. However the overall percentage of household disposable income going to debt payments is still below its prepandemic low.

Mark Zandi, the chief economist at Moody’s Analytics, has been among the many extra bullish monetary commentators since recession considerations grew in 2022.

However a yr in the past, when the regional banking system started to tremble a bit from rate of interest shocks, he grew extra fearful. Mr. Zandi suggested his son, an entrepreneur, that he was unlikely to get a line of credit score as a result of financial institution lending was in all probability about to tighten.

“He knocked on JPMorgan Chase’s door and so they gave him a line of credit score inside two hours,” Mr. Zandi mentioned with fun. “And, , it was a fairly sizable line.”

That flip of occasions is emblematic of a little-noticed shift in enterprise circumstances. Because the center of final yr, when financial progress tremendously exceeded forecasts, the share of banks tightening lending to small businesses has eased considerably. That pattern is in keeping with an rising conviction amongst enterprise leaders {that a} downturn just isn’t imminent, and a doubtlessly elongated enlargement makes betting on upstart corporations extra enticing.

Frustration with the cumulative rise in costs during the last three years continues to agitate client sentiment. However customers and companies, in some ways, are nonetheless in wholesome form general, mentioned Daniel Alpert, a senior fellow in monetary macroeconomics at Cornell Legislation College and a founding managing companion of Westwood Capital, an funding financial institution.

“Had been it not for the post-pandemic inflation spike and excessive rates of interest,” he mentioned, this economic system “can be hailed as one of many biggest turnarounds in historical past.”

RELATED POSTS

View all