June 26, 2024 | by Kaju

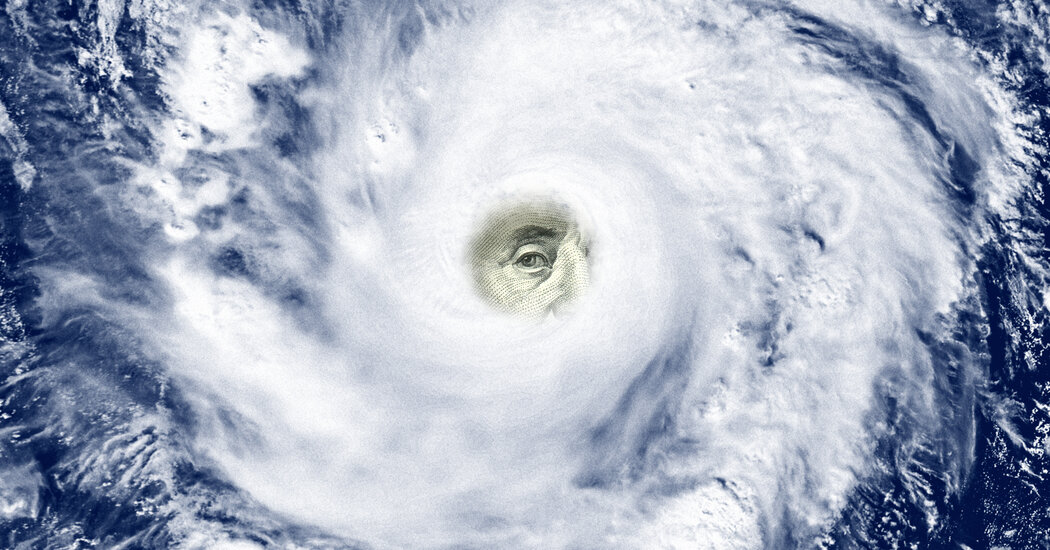

A staff of economists not too long ago analyzed 20 years of peer-reviewed analysis on the social value of carbon, an estimate of the injury from local weather change. They concluded that the typical value, adjusted for improved strategies, is considerably larger than even the U.S. authorities’s most recent determine.

Meaning greenhouse gasoline emissions, over time, will take a bigger toll than regulators are accounting for. As instruments for measuring the hyperlinks between climate patterns and financial output evolve — and the interactions between climate and the economic system enlarge the prices in unpredictable methods — the injury estimates have solely risen.

It’s the type of knowledge that one may anticipate to set off alarm bells throughout the monetary business, which intently tracks financial developments that may have an effect on portfolios of shares and loans. But it surely was onerous to detect even a ripple.

In truth, the information from Wall Avenue these days has largely been about retreat from local weather objectives, relatively than recommitment. Banks and asset managers are withdrawing from worldwide local weather alliances and chafing at their guidelines. Regional banks are stepping up lending to fossil gasoline producers. Sustainable funding funds have sustained crippling outflows, and lots of have collapsed.

So what explains this obvious disconnect? In some instances, it’s a basic prisoner’s dilemma: If companies collectively shift to cleaner power, a cooler local weather advantages everybody extra sooner or later. However within the quick time period, every agency has a person incentive to money in on fossil fuels, making the transition a lot more durable to realize.

And with regards to avoiding local weather injury to their very own operations, the monetary business is genuinely struggling to understand what a warming future will imply.

To grasp what’s happening, put your self within the sneakers of a banker or an asset supervisor.

In 2021, President Biden introduced the USA again into the Paris Settlement, and his monetary regulators began issuing reports in regards to the threat that local weather change posed to the monetary system. A worldwide compact of monetary establishments made commitments worth $130 trillion to attempt to convey down emissions, assured that governments would create a regulatory and monetary infrastructure to make these investments worthwhile. And in 2022, the Inflation Discount Act handed.

Since then, a whole lot of billions of {dollars} have flowed into renewable-energy tasks in the USA. However that doesn’t imply they’re a certain guess for individuals paid to construct funding methods. Clear-energy shares have been pummeled by excessive rates of interest and supply-chain hiccups, ensuing within the cancellation of offshore wind tasks. Should you purchased among the largest solar-energy exchange-traded funds in early 2023, you’d have misplaced about 20 % of your cash, whereas the remainder of the inventory market soared.

“If we take into consideration what’s going to be one of the best ways to tilt your portfolios within the route to learn, it’s actually tough to do,” stated Derek Schug, the top of portfolio administration for Kestra Funding Administration. “These will most likely be nice investments over 20 years, however once we’re judged over one to 3 years, it’s a bit of tougher for us.”

Some companies cater to institutional purchasers, like public worker pension funds, that need combating local weather change to be a part of their funding technique and are keen to take a short-term hit. However they aren’t a majority. And over the previous couple of years, many banks and asset managers have shrunk from something with a local weather label for worry of dropping enterprise from states that frown on such issues.

On high of that, the battle in Ukraine scrambled the monetary case for backing a speedy power transition. Synthetic intelligence and the motion towards better electrification are including demand for energy, and renewables haven’t stored up. So banks kept lending to oil and gas producers, which have been churning out file income. Jamie Dimon, the chief government of JPMorgan Chase, stated in his annual letter to shareholders that merely halting oil and gasoline tasks could be “naïve.”

All of that’s in regards to the relative attraction of investments that will sluggish local weather change. What in regards to the threat that local weather change poses to the monetary business’s personal investments, by means of extra highly effective hurricanes, warmth waves that knock out energy grids, wildfires that wipe out cities?

There’s proof that banks and traders worth in some bodily threat, but in addition that a lot of it nonetheless lurks, unheeded.

Over the previous yr, the Federal Reserve requested the nation’s six largest banks to look at what would occur to their stability sheets if a big hurricane hit the Northeast. A summary final month reported that the establishments discovered it tough to evaluate the affect on mortgage default charges due to a ignorance on property traits, their counterparties and particularly insurance coverage protection.

Parinitha Sastry, an assistant professor of finance at Columbia Enterprise Faculty, studied shaky insurers in states like Florida and located that protection was usually a lot weaker than it appeared, making mortgage defaults after hurricanes likelier.

“I’m very, very apprehensive about this, as a result of insurance coverage markets are this opaque weak hyperlink,” Dr. Sastry stated. “There are parallels to among the advanced linkages that occurred in 2008, the place there’s a weak and unregulated market that spills over to the banking system.”

Regulators fear that failing to grasp these ripple results couldn’t simply put a single financial institution in bother however even turn into a contagion that will undermine the monetary system. They’ve set up systems to watch potential issues, which some monetary reformers have criticized as insufficient.

However whereas the European Central Financial institution has made climate risk a consideration in its coverage and oversight, the Federal Reserve has resisted taking a extra energetic position, regardless of indications that excessive climate is feeding inflation and that top rates of interest are slowing the transition to wash power.

“The argument has been, ‘Until we are able to convincingly present it’s a part of our mandate, Congress ought to cope with it, it’s none of our enterprise,’” stated Johannes Stroebel, a finance professor at New York College’s Stern Faculty of Enterprise.

Finally, that view may show appropriate. Banks are within the enterprise of threat administration, and as instruments for local weather forecasting and modeling enhance, they’ll cease lending to clearly at-risk companies and locations. However that solely creates extra issues for the individuals in these locations when credit score and enterprise funding dry up.

“You’ll be able to conclude it’s not a risk to monetary stability, and there can nonetheless be giant financial losses,” Dr. Stroebel famous.

Whereas assessing the place the dangers lie in a single’s portfolio stays tough, a a lot nearer-term uncertainty looms: the result of the U.S. election, which might decide whether or not additional motion is taken to deal with local weather issues or present efforts are rolled again. An aggressive local weather technique won’t fare as effectively throughout a second Trump administration, so it could appear smart to attend and see the way it shakes out.

“Given the best way our system has moved to date, it’s so sluggish transferring that there’s nonetheless time to get on the opposite aspect of the proverbial fence,” stated Nicholas Codola, a senior portfolio supervisor at Brinker Capital Investments.

John Morton served as a local weather counselor to Treasury Secretary Janet L. Yellen earlier than rejoining the Pollination Group, a climate-focused advisory and funding administration agency. He has noticed that massive corporations are hesitating on climate-sensitive investments as November approaches, however says that “two issues are misguided and fairly harmful about that speculation.”

One: States like California are establishing stricter rules for carbon-related monetary disclosures and will step it up additional if Republicans win. And two: Europe is phasing in a “carbon border adjustment mechanism,” which can punish polluting corporations that need to do enterprise there.

“Our view is, watch out,” Mr. Morton stated. “You’re going to be deprived out there in the event you’re left holding a giant bag of carbon 10 years from now.”

However in the intervening time, even European monetary establishments really feel stress from the USA, which — whereas offering among the most beneficiant subsidies to date for renewable-energy funding — has not imposed a worth on carbon.

The worldwide insurance coverage firm Allianz has set out a plan to align its investments in a means that will stop warming above 1.5 levels Celsius by the tip of the century, if everybody else did the identical. But it surely’s tough to steer a portfolio to climate-friendly belongings whereas different funds tackle polluting corporations and reap short-term income for impatient purchasers.

“That is the principle problem for an asset supervisor, to actually convey the client alongside,” stated Markus Zimmer, an Allianz economist. Asset managers don’t have ample instruments on their very own to maneuver cash out of polluting investments and into clear ones, in the event that they need to keep in enterprise, he stated.

“After all it helps if the monetary business is in some way formidable, however you can’t actually substitute the dearth of actions by policymakers,” Dr. Zimmer added. “Ultimately, it’s very onerous to get round.”

Based on new research, the profit is larger when decarbonization happens sooner, as a result of the dangers of utmost injury mount as time goes on. However with out a uniform algorithm, somebody is certain to scoop up the fast income, disadvantaging people who don’t — and the longer-term end result is adversarial for all.

“The worst factor is in the event you commit your corporation mannequin to 1.5-degree compliance, and three levels are realized,” Dr. Zimmer stated.

RELATED POSTS

View all