July 6, 2024 | by Kaju

Midway by way of the 12 months, and 4 years faraway from the downturn set off by the coronavirus pandemic, the U.S. job engine remains to be cruising — even when it reveals elevated indicators of downshifting.

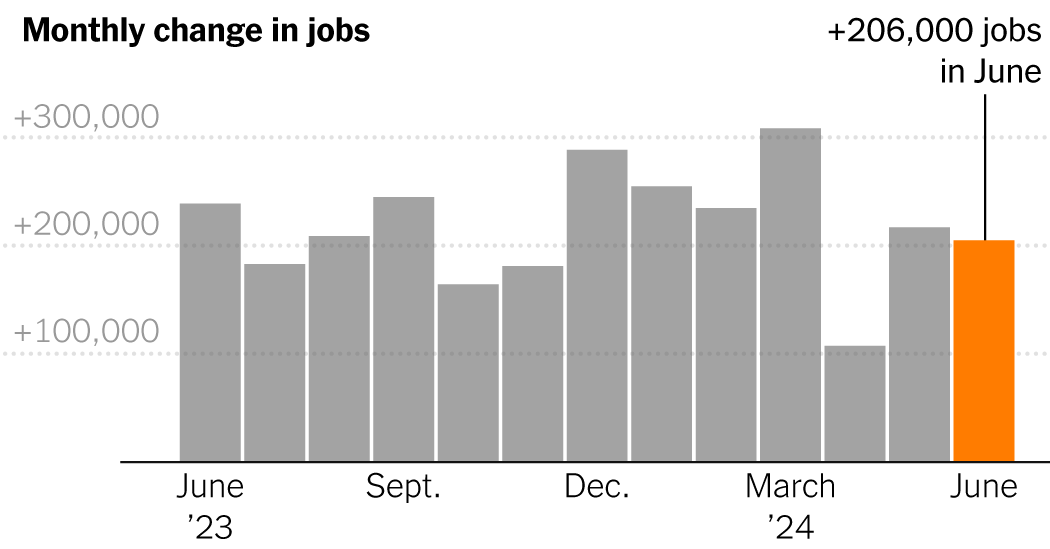

Employers delivered one other strong month of hiring in June, the Labor Division reported on Friday, including 206,000 jobs within the forty second consecutive month of job development.

On the identical time, the unemployment fee ticked up one-tenth of a degree to 4.1 p.c, up from 4 p.c and surpassing 4 p.c for the primary time since November 2021.

The achieve in jobs was barely higher than most analysts had forecast. However totals for the 2 earlier months had been revised downward, and the uptick in unemployment was surprising. That has led many economists and buyers to shift from having full religion within the jobs market to having some concern for it.

“These numbers are good numbers,” stated Claudia Sahm, the chief economist for New Century Advisors, cautioning towards overly detrimental interpretations of the report.

However “the significance of the unemployment fee is it could actually truly inform us a bit about the place we is likely to be going,” she added, noting that the speed had been drifting up since hitting a half-century low of three.4 p.c early final 12 months.

Wage positive aspects have additionally been moderating. Common hourly earnings rose 0.3 p.c in June from the earlier month, and three.9 p.c from a 12 months earlier, in contrast with a 4.1 p.c year-over-year change in Could. However in excellent news for employees, pay positive aspects have been outpacing inflation for a couple of 12 months.

The market response to the report on Friday was muted, with shares rising modestly. Yields on authorities bonds fell, nevertheless, reflecting merchants’ rising confidence that the Federal Reserve will start reducing rates of interest.

The benchmark rate of interest, close to zero firstly of 2022, has now been above 5 p.c for greater than a 12 months within the Fed’s push to get inflation below management. The influence on lending throughout the financial system has continued longer than many companies — or households seeking to purchase a home or a automobile — had reckoned.

Most economists anticipate additional deceleration in job and wage development till the Fed acts to ease credit score circumstances. There may be rising proof of slowing.

Layoffs are close to report lows, however an indicator generally known as the hiring fee — which tracks the variety of hires throughout a month as a share of total employment — has fallen considerably. Which means the comparatively few folks shedding their jobs are, normally, having extra hassle discovering new alternatives.

Roughly three-quarters of the job positive aspects within the June report got here from well being care, social help and authorities. A number of different industries produced scant will increase, and a few, together with manufacturing and retail, shed jobs total.

A lot of the federal government hiring is a part of a long-anticipated catch-up by state and local governments, which have lamented understaffing and solely not too long ago recovered to their prepandemic employment peaks. And the growing older of the American inhabitants has created persistently excessive demand for well being care employees and different care work.

Economists are likely to really feel extra assured, although, when the majority of employment positive aspects are coming from sectors extra indicative of private-sector momentum.

“Job postings are trending down,” stated Nick Bunker, an financial analysis director on the recruitment website Certainly.

That will partly clarify why the ranks of the long-term unemployed — these out of labor for 27 weeks or extra — is now above its 2017-19 common.

With inflation at 2.6 p.c, not removed from the Fed’s goal of two p.c, some analysts are frightened that the central financial institution’s present stance might find yourself upending the job market. Fed officers have signaled over the previous month that they might react to a abruptly weakening labor market by reducing charges, that are at the moment at a decades-long excessive.

Policymakers on the Fed will meet later this month and once more in September to set fee coverage. Some buyers and monetary analysts reacting to the June employment numbers stated officers mustn’t threat ready too lengthy.

“Circumstances within the labor market are cooling off,” stated Neil Dutta, the pinnacle of financial analysis at Renaissance Macro Analysis, a monetary agency. “The trade-offs for the Fed have shifted. In the event that they don’t reduce this month, they must make a robust sign a reduce is coming in September.”

Because the monetary world awaits the subsequent transfer, U.S. households have continued to spend at a wholesome, if considerably subdued, tempo. Previously month, the Transportation Safety Administration screened a report variety of vacationers at airports. Latest company earnings studies instructed that customers, whereas pickier than earlier than, remained in good condition total. For the reason that begin of the 12 months, the inventory market has reached recent highs, recording a formidable 17 p.c return.

In some ways, the monetary image for American households is brighter than it was earlier than the pandemic. On the finish of 2019, U.S. households held roughly $980 billion in “checkable deposits” — the sum of money property in checking, financial savings and cash market accounts. Now, the determine stands at more than $4 trillion.

Whereas that wealth is concentrated toward the top overall, wealth and earnings positive aspects have been widespread. The web price held by the underside 50 p.c of households, about $1.9 trillion on the eve of the pandemic, is now round $3.8 trillion. And for employees who aren’t managers — roughly eight of 10 folks within the work power — wage development has been far stronger than the general common.

For privately owned companies with fewer assets than these of enormous companies, the financial system of the final 4 years has typically introduced a nauseating curler coaster of challenges. That’s been the case for the brothers Mazen and Afif Baltagi, who personal quite a lot of hospitality companies within the Houston space — an occasion area, a sports activities bar and some cafes — together with some funding companions.

Crowds aren’t fairly what they had been in 2021 and 2022, when folks had been spending with extra euphoria. And “it’s not a simple enterprise,” Mazen Baltagi stated, particularly since meals, labor and development prices have jumped and largely stayed elevated.

Nonetheless, from his vantage level, “Texas is booming.”

On this interest-rate atmosphere, “banks aren’t actually lending to eating places proper now,” he added, however he stated he and his brother had been working round that, making sufficient in gross sales — and from new fairness companions — to undertake upcoming expansions.

That mixture of adaptability and profitability amongst companies is a pattern of the forces that helped america keep away from the recession that many specialists anticipated. However surveys of enterprise executives recommend that many are ready for the price of credit score to fall earlier than diving into new waves of hiring or capital investments.

Now the query, it appears, is whether or not the Fed will reduce rates of interest in time to maintain the growth going. Further knowledge studies about client costs will show essential because the summer time rolls on.

The monetary markets “simply want the inflation knowledge to cooperate,” stated Samuel Rines, an economist and macro strategist at WisdomTree, an funding administration agency. “Then it’s recreation on.”

RELATED POSTS

View all