January 16, 2025 | by

Shopper costs rose extra shortly in December, the newest signal that the Federal Reserve’s battle in opposition to inflation could have stalled.

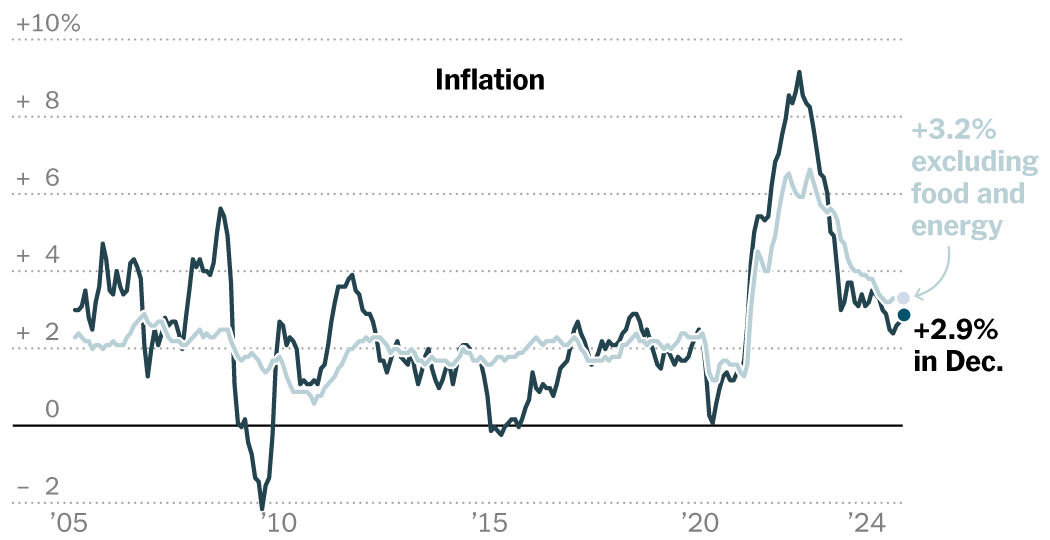

The Shopper Value Index rose 0.4 % from November, and was up 2.9 % from a yr earlier, the Labor Division mentioned on Wednesday. It was the quickest one-month enhance in total costs since February, pushed partly by one other sharp rise within the value of eggs and different groceries.

The “core” measure of inflation, which strips out risky meals and gas costs to offer a greater sense of the underlying pattern, was extra encouraging: The index rose 3.2 % from a yr earlier after three straight months of three.3 % positive factors. Forecasters had not anticipated core inflation to sluggish.

Inflation has cooled considerably because the center of 2022, when it hit a four-decade excessive of greater than 9 %. Extra lately, nonetheless, progress has slowed, and even stopped outright: By some measures, inflation hardly improved in 2024.

“Once you step again and have a look at the general state of inflation, we’re not likely going wherever,” mentioned Sarah Home, senior economist at Wells Fargo. “Whereas there was progress, the tempo has been actually disappointing.”

Costs continued to rise in a number of the classes that matter most to customers. Grocery costs, which have been comparatively flat in late 2023 and early 2024, are rising once more, led by the value of eggs, which is up by greater than a 3rd over the previous yr. Fuel costs jumped 4.4 % in December, though they have been decrease than a yr in the past.

And with inflation proving extra cussed than policymakers had hoped, Individuals will probably want to attend longer to see decrease rates of interest on their mortgages, automobile loans and bank card balances.

Officers on the Fed have voiced rising concern concerning the sluggish progress on inflation, and whereas a number of the particulars in Wednesday’s report have been encouraging, the information is unlikely to do a lot to ease these issues. Inventory costs rose and bond yields fell on Wednesday as buyers breathed a sigh of aid that the inflation information wasn’t worse. The S&P 500 rose 1.8 %, its finest one-day efficiency because the election in November. The ten-year Treasury yield, which underpins rates of interest from mortgages to company loans, fell 0.15 share factors, its largest one-day fall in virtually six months.

On the similar time, the continued power of the labor market — together with information launched final week displaying unexpectedly sturdy job development in December — has made policymakers much less frightened that their efforts to rein in value will increase have been resulting in layoffs or inflicting harm to the broader financial system.

Because of this, buyers broadly anticipate the central financial institution to carry rates of interest regular at its assembly later this month. That might break a streak of three consecutive charge cuts, and a few forecasters now say that policymakers could not decrease charges in any respect this yr.

“With a labor market that’s stabilizing, with inflation already above goal and with dangers additional to the upside, I believe it’s troublesome to make a case to maintain slicing,” mentioned Aditya Bhave, an economist at Financial institution of America.

Most Fed officers have mentioned they nonetheless anticipate inflation to chill progressively, and economists agree that there’s purpose to be optimistic. Inflation in housing — by far the most important month-to-month expense for many households, and one of the cussed classes of shopper costs — has lastly begun to ease: Shelter costs have been up 4.6 % in December from a yr earlier, the smallest 12-month enhance in practically three years. Providers costs outdoors housing — a measure that Fed officers have watched intently lately as a sign of the place total inflation is headed — additionally continued to chill. And information launched on Tuesday confirmed that wholesale costs rose extra slowly in December.

However policymakers are dealing with a brand new supply of uncertainty: President-elect Donald J. Trump. The incoming president has promised to impose steep tariffs on imports, limit immigration and reduce taxes — insurance policies that economists warn may push up costs additional, though it’s unclear by how a lot. Some Fed officers have mentioned they’re already factoring these insurance policies into their outlook for inflation.

With value will increase proving cussed and the labor market wanting sturdy, policymakers are unlikely to chop charges once more till they get a clearer image of what insurance policies the brand new administration is adopting and the way they’re affecting the financial system, mentioned James Egelhof, chief U.S. economist at BNP Paribas.

“The Fed has the luxurious of a bit little bit of time to attend for President Trump to take workplace and to see precisely what occurs,” he mentioned.

Joe Rennison contributed reporting.

RELATED POSTS

View all