January 30, 2025 | by

Progress slowed however remained resilient on the finish of 2024, leaving the U.S. financial system on stable footing heading into a brand new 12 months — and a brand new presidential administration — that is stuffed with uncertainty.

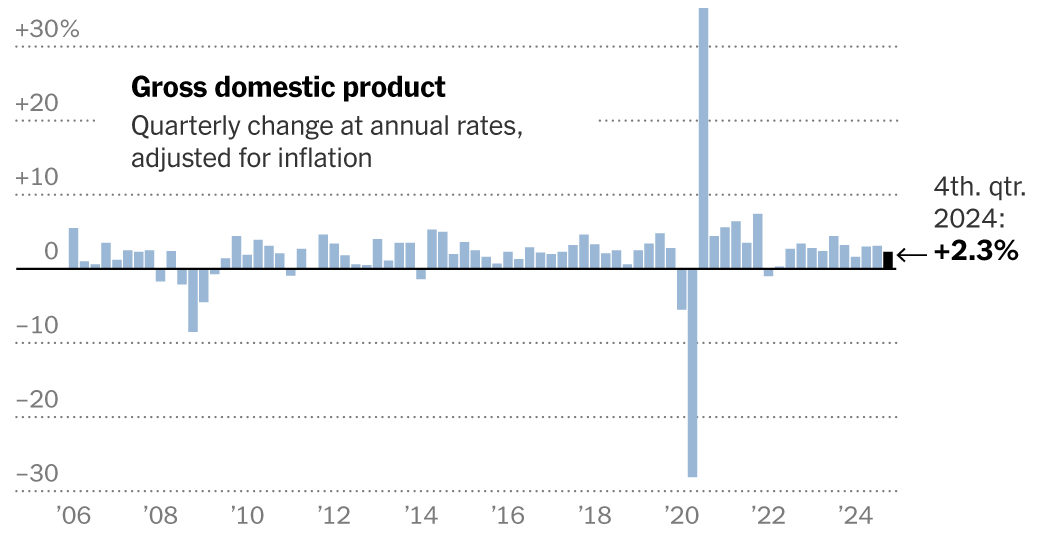

U.S. gross home product, adjusted for inflation, grew at a 2.3 % annual price within the fourth quarter of final 12 months, the Commerce Division reported on Thursday. That was down from the three.1 % development price within the third quarter however nonetheless represented an encouraging finish to a 12 months during which the financial system as soon as once more defied expectations.

The figures are preliminary and will likely be revised no less than twice as extra full information turns into out there.

For the 12 months as a complete, measured from the top of 2023 to the top of 2024, G.D.P. elevated 2.5 %, far forward of forecasters’ expectations when the 12 months started. Sturdy client spending, underpinned by low unemployment and regular wage development, helped hold the financial system on monitor regardless of excessive rates of interest, cussed inflation and political turmoil at house and overseas.

“We ended on a fairly robust be aware,” stated Diane Swonk, chief economist for the accounting agency KPMG. “It’s gorgeous how resilient and robust the financial system has been.”

However the financial system entered the brand new 12 months dealing with a brand new set of challenges. The whirlwind begin to President Trump’s second time period — together with sweeping adjustments to immigration coverage, a spending freeze that was introduced after which rescinded, and steep tariffs that would start to take impact as early as this weekend — has elevated uncertainty for each households and companies. And whereas the total scope of Mr. Trump’s plans stays unclear, economists warn that his proposals on commerce and immigration, specifically, might result in quicker inflation, slower development, or each.

“You actually have all the best components to assist sustainable development, however the query is, the place will or not it’s in 12 months’ time?” stated Gregory Daco, chief economist for the consulting agency EY-Parthenon. “The danger is you break the financial system.”

Nonetheless, the financial system entered 2025 with important momentum, led by client spending, which grew at a 4.2 % annual price within the fourth quarter, forward of forecasters’ expectations. Shoppers have been buoyed by a robust job market, which has allowed pay to rise quicker than costs in latest quarters: After-tax earnings, adjusted for inflation, elevated at a 2.8 % annual price on the finish of final 12 months.

The housing market, too, confirmed indicators of life on the finish of the 12 months, as a drop in mortgage charges spurred building exercise. Residential funding, which incorporates new house constructing and renovation, rose after two straight quarterly declines.

However there are additionally pockets of weak spot. Companies invested much less in new buildings and gear within the fourth quarter, and exports fell. The rebound within the housing market could show short-lived: Mortgage charges have risen in latest months, and the marketplace for current properties stays frozen.

On the identical time, client costs rose extra shortly on the finish of the 12 months, the newest proof that progress on inflation has stalled. That has sophisticated the job dealing with policymakers on the Federal Reserve, who till not too long ago had been anticipating to be reducing rates of interest so as to shore up financial development. As a substitute, the Consumed Wednesday held charges regular and signaled that the bar for future price cuts will likely be excessive.

Nonetheless, economists have warned for years for years that development is at risk of faltering, solely to be proved incorrect. And the momentum on the finish of 2024 ought to assist the financial system stand up to no matter new threats emerge in 2025.

“We’ve been in a position to take quite a bit and hold going,” Ms. Swonk stated. “We will have a look at all of the fashions, however the fashions haven’t been that worthwhile.”

RELATED POSTS

View all