February 9, 2024 | by Kaju

A congressional investigation has decided that 5 American enterprise capital companies invested greater than $1 billion in China’s semiconductor business since 2001, fueling the expansion of a sector that america authorities now regards as a nationwide safety menace.

Funds equipped by the 5 companies — GGV Capital, GSR Ventures, Qualcomm Ventures, Sequoia Capital and Walden Worldwide — went to greater than 150 Chinese language corporations, in line with the report, which was launched Thursday by each Republicans and Democrats on the Home Choose Committee on the Chinese language Communist Celebration.

The investments included roughly $180 million that went to Chinese language companies that the committee stated instantly or not directly supported Beijing’s navy. That features corporations that the U.S. authorities has stated present chips for China’s navy analysis, tools and weapons, equivalent to Semiconductor Manufacturing Worldwide Company, or SMIC, China’s largest chipmaker.

The report by the Home committee focuses on investments made earlier than the Biden administration imposed sweeping restrictions aimed toward chopping off China’s entry to American financing. It doesn’t allege any illegality.

In August, the Biden administration barred U.S. enterprise capital and personal fairness companies from investing in Chinese language quantum computing, synthetic intelligence and superior semiconductors. It has additionally imposed worldwide limits on gross sales of superior chips and chip-making machines to China, arguing that these applied sciences may assist advance the capabilities of the Chinese language navy and spy companies.

Because it was established a yr in the past, the committee has referred to as for elevating tariffs on China, focused Ford Motor and others for doing enterprise with Chinese language corporations, and spotlighted pressured labor issues involving Chinese language procuring websites.

The report beneficial that Congress curb investments in all Chinese language entities which can be topic to sure U.S. commerce restrictions or included on federal “crimson flag” lists, in addition to their dad or mum corporations and subsidiaries. That would come with corporations that work with the Chinese language navy or have ties to pressured labor in China’s Xinjiang area. The U.S. authorities must also contemplate imposing controls on different industries, like biotechnology and fintech, Consultant Raja Krishnamoorthi of Illinois, the committee’s rating Democrat, stated.

Sequoia stated in June, earlier than the committee introduced its investigation into non-public funding, that it might separate its China arm from its U.S. operations and rename it HongShan. A number of months later, GGV Capital stated it might separate its Asia-focused enterprise.

Walden didn’t reply to a request for remark. A consultant from GSR declined to remark. GGV supplied a listing of corrections and clarifications to the report and said that it had been in compliance with all relevant legal guidelines. GGV can also be making an attempt to promote its stakes in three corporations mentioned within the report.

A Sequoia spokeswoman stated the agency took U.S. nationwide safety points severely and had at all times had processes in place to make sure compliance with U.S. legislation. The agency accomplished its cut up from HongShan on Dec. 31.

A Qualcomm spokeswoman stated its investments had been small in contrast with these of the enterprise capital companies and made up lower than 2 % of the investments mentioned within the report.

Officers in Washington more and more see enterprise ties even with non-public Chinese language expertise corporations as problematic, arguing that China has tried to attract on the experience of the non-public sector to modernize its navy.

Committee leaders conceded that many of those investments had been made when america was encouraging higher financial engagement with China.

“All of us made this guess 20 years in the past on China’s integration into the worldwide economic system, and it was logical,” stated Consultant Mike Gallagher of Wisconsin, the committee’s chairman. “It simply occurred to have failed.” He added, “Now, I simply I believe there’s no excuse anymore.”

The 57-page report attracts on data supplied to the committee by the companies about their investments, in addition to interviews with senior executives at a number of companies.

The committee’s report checked out simply a few of the funding flowing to China. Between 2016 and July 2023, Chinese language semiconductor corporations raised $8.7 billion in offers that included U.S. funding companies, in line with PitchBook, which tracks start-up funding. That funding peaked in 2021.

Enterprise capital companies pursued aggressive international growth, significantly into Asia, for a number of a long time. However they’ve identified for the reason that Trump administration took a extra aggressive stance towards China that investments in Chinese language corporations could be topic to rising scrutiny.

“Nobody is touching China now,” stated Linus Liang, an investor on the enterprise agency Kyber Knight Capital.

Splitting off funding entities with ties to China, as Sequoia and GGV did, could not resolve the committee’s issues that American financing and expertise will find yourself in Chinese language corporations, the report said. Sequoia’s newly separated Chinese language-based agency, HongShan, counts U.S. buyers amongst its backers. And HongShan and GGV’s new unit, GGV Asia, may nonetheless spend money on U.S. start-ups, the report stated.

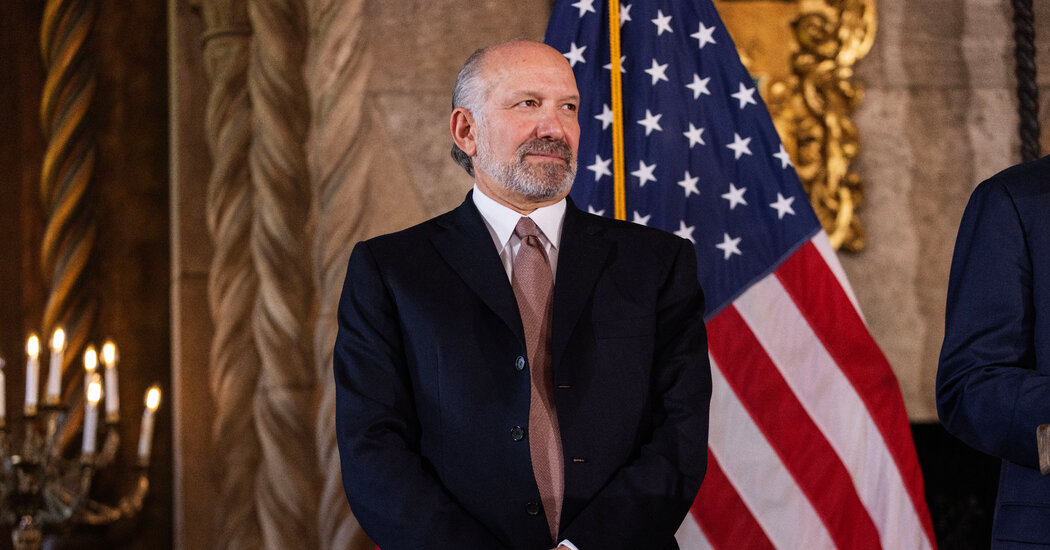

A lot of the report focuses on Walden Worldwide, a California-based firm that was one the earliest and most influential overseas buyers within the Chinese language chip sector. Walden is led by Lip-Bu Tan, a former chief govt of Cadence Design Programs, a chip design agency, and a present member of Intel’s board.

Walden Worldwide created numerous funds for the chip sector in partnership with the Chinese language authorities and Chinese language state-owned corporations, together with a outstanding navy provider, the report stated.

It was a founding shareholder and early supply of financing for SMIC, which is now topic to U.S. commerce restrictions due to its ties to the Chinese language navy. Walden gave $52 million to SMIC over a number of a long time, the committee discovered, in addition to tens of tens of millions of {dollars} to SMIC associates. Mr. Tan additionally served on SMIC’s board of administrators.

He’s credited with bringing SMIC and different companies a mix of financing, instruments and mental property for chip design, in addition to worthwhile connections with prospects.

Whereas the U.S. authorities labeled SMIC a “trusted customer” in 2007, skepticism of the corporate’s actions has grown in Washington in more moderen years. As we speak, the corporate is essential to China’s ambitions to create a thriving chip sector and reduce its dependence on america.

Walden, together with Qualcomm Ventures, the investing arm of chipmaker Qualcomm, invested tens of tens of millions of {dollars} into Superior Micro-Fabrication Tools, or AMEC, a Chinese language firm that makes the machines wanted to fabricate chips. AMEC, a provider to SMIC and different Chinese language chipmakers, is significant to China’s efforts to construct up its chip-making business after america positioned restrictions on promoting China probably the most superior chip-making machines.

China’s semiconductor corporations are properly funded by the nation’s authorities. However ties with U.S. enterprise capital companies present Chinese language corporations with managerial experience in addition to entry to expertise and the American and European markets. American enterprise capital companies have additionally tried to sway U.S. officers and regulators on behalf of Chinese language corporations of their portfolio, like TikTok.

RELATED POSTS

View all