The American job market could also be shifting right into a decrease gear this spring, a flip that economists have anticipated for months after a vigorous rebound from the pandemic shock.

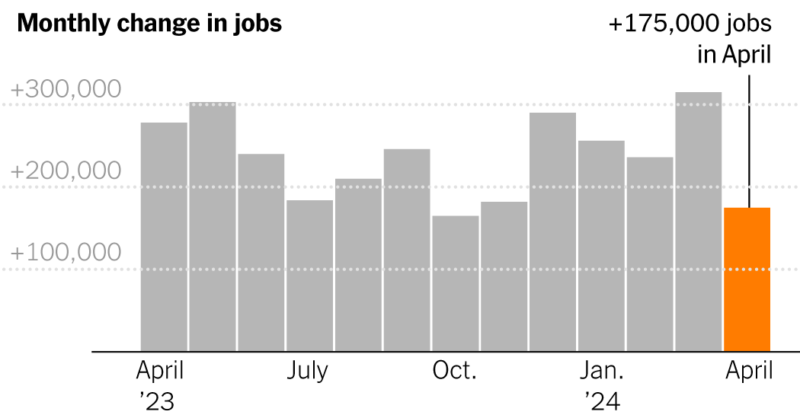

Employers added 175,000 positions in April, the Labor Division reported Friday, undershooting forecasts. The unemployment price ticked as much as 3.9 %.

A much less torrid enlargement after the 242,000-job common over the prior 12 months isn’t essentially dangerous information, provided that layoffs have remained low and most sectors seem steady.

“It’s not a foul financial system; it’s nonetheless a wholesome financial system,” mentioned Perc Pineda, chief economist on the Plastics Trade Affiliation. “I feel it’s a part of the cycle. We can’t proceed sturdy development indefinitely contemplating the boundaries of our financial system.”

The labor market has defied projections of a substantial slowdown for over a 12 months within the face of a fast escalation in borrowing prices, a minor banking disaster and two main wars. However financial development declined markedly within the first quarter, suggesting that the exuberance of the final two years is perhaps settling right into a extra sustainable rhythm.

Wage development eased, with common hourly earnings up 3.9 % from a 12 months earlier, in contrast with 4.1 % within the March report. Swift wage development within the first quarter, evidenced by a hotter-than-expected Employment Cost Index studying, could have partly mirrored raises and minimum-wage will increase that took impact in January in addition to new union contracts.

The variety of hours labored per week sank, one other sign that employers want much less staffing. A broader measure of unemployment that features individuals working half time for financial causes edged as much as 7.4 %, from report lows in late 2022.

The findings could also be welcome information for the Federal Reserve, which has held rates of interest regular as inflation has remained cussed. Though the Fed chair, Jerome H. Powell, mentioned this week that he wasn’t focusing on decrease wage development, he added that sustained sizzling pay features may forestall inflation from subsiding.

Bond yields fell on the brand new information, indicating a perception that the Fed could minimize charges this 12 months after some doubt that it could accomplish that, and shares rallied.

President Biden celebrated the report as a continuation of the “nice American comeback,” however his presumptive rival within the November election, former President Donald J. Trump, characterised it as “HORRIBLE JOBS NUMBERS” on his Fact Social platform. Underneath Mr. Trump’s presidency, earlier than the pandemic took maintain in March 2020, month-to-month job will increase averaged about 180,000 — only a tad greater than April’s achieve.

The April exhibiting is in step with different indicators of slackening situations which have mounted in current months: Job openings have fallen substantially from their peak two years in the past, and staff are quitting their jobs at decrease charges than they had been earlier than the pandemic. And the hiring figures for February and March, which got here in greater than forecast, could have been flattered by an unusually heat winter.

“We’ve seen a major easing in labor demand, and it’s not a shock that hiring can be slowing down on this financial surroundings the place rates of interest are nonetheless elevated,” mentioned Lydia Boussour, a senior economist on the consulting agency EY-Parthenon.

Employment development has been narrowing to a couple industries, and that development held in April’s seasonally adjusted numbers, with well being care — which is powered by ageing demographics and doesn’t fluctuate as a lot with financial cycles — accounting for a 3rd of the expansion.

Leisure and hospitality employment rose solely barely, arresting what had been pretty swift development because the business approaches its prepandemic staffing ranges.

The impact of upper rates of interest has been clearly seen in manufacturing, a capital-intensive sector the place employment has basically been flat since late 2022. Federal incentives for the manufacturing of semiconductors and clear vitality gear are producing funding, however the employment affect has been muted.

That’s true at Voith Hydro in York, Pa., a maker of equipment for dams and pump storage amenities, that are a solution to handle electrical energy demand. Some orders have been accelerated by the Infrastructure Funding and Jobs Act, and a tax break within the Inflation Discount Act just lately supported the set up of recent gear.

Whereas Voith signed a brand new contract with its unionized staff final 12 months with higher wages and advantages to stay aggressive with close by employers, its work drive of 350 hasn’t notably expanded.

“There are fewer individuals getting into the trades, and there’s a smaller pool of individuals to select from,” mentioned Carl Atkinson, vp of gross sales and advertising and marketing for the hydropower division. “That merely is difficult a complete group of producers to be extra environment friendly.”

That technique has contributed to sturdy productiveness development over the previous a number of quarters, which has helped wages to rise quicker than costs. Relying on how many individuals begin searching for work, such efficiencies may also immediate the unemployment price to float greater. However up to now, the availability of staff has been a vital issue propelling the surprisingly sturdy employment development of the previous two years.

A part of that stems from the elevated circulation of each authorized and undocumented immigrants, which added about 80,000 staff month-to-month to the labor drive final 12 months, in accordance with calculations by Goldman Sachs, and can add one other 50,000 per 30 days this 12 months. Economists on the Brookings Establishment estimated that immigration would permit 160,000 to 200,000 jobs a month to be added in 2024 with out fueling inflation.

However the availability of staff has additionally been amplified by girls between the ages of 25 and 54 — usually thought-about prime working years — who set a labor drive participation report of 78 % in April.

Amongst these again within the job market this 12 months is Juliette Gore, 46, who labored in gross sales for the credit score reporting firm Equifax earlier than taking time without work to boost her three sons. She then began a pc networking gear enterprise together with her husband in an Atlanta suburb, however bought her stake after they divorced in 2022.

After taking a 12 months to renovate her home, Ms. Gore began searching for jobs in early 2024. It turned out to be dangerous timing, as skilled companies employers had been pulling again after a interval of fast hiring. She despatched dozens of purposes however has landed solely two interviews, and the closest factor to a job supply paid far lower than she would settle for.

“I really feel it’s going to take for much longer than I anticipated,” Ms. Gore mentioned. “Some are saying issues received’t lookup till early subsequent 12 months.”

Declining job availability can also be pushing some individuals to show to gig employment, which doesn’t present up within the month-to-month employer survey. In accordance with a Bank of America analysis of its personal information, the share of accounts with app-based revenue reached a report excessive within the first three months of this 12 months, largely from ride-sharing revenue.

A rising unemployment price may restrain spending by shoppers, who’ve additionally been burning by financial institution balances constructed in the course of the pandemic, however nonetheless go away an financial system that’s nonetheless basically sound.

“We’re nonetheless forecasting what we’d name a modest slowdown, however we’ve bought the image bettering once more,” mentioned Stephen Brown, deputy chief North America economist for Capital Economics. “For the common employee, it’s not going to really feel like a slowdown.”