March 31, 2025 | by

America is extra affluent than ever.

U.S. family web price reached a new peak on the finish of 2024. The unemployment price has levitated simply above document lows for 3 years. The general debt that households are carrying in contrast with the belongings they personal can be near a record low.

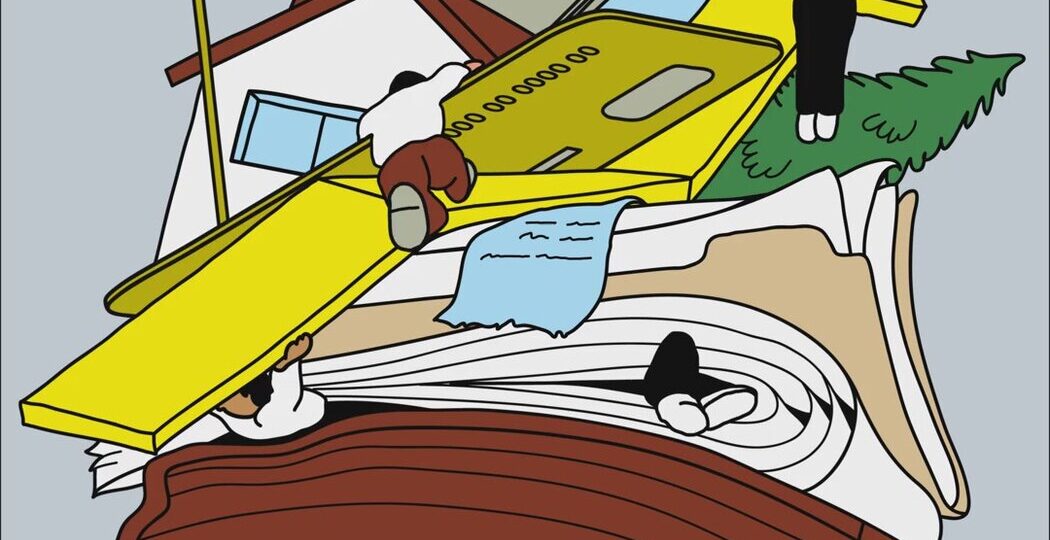

However even a land of lots has its shortcomings, influencing each perceptions and realities of how Individuals are doing.

The U.S. economic system stays deeply unequal, with huge gaps in wealth and financial security persisting at the same time as inflation has ebbed and incomes have risen. And information designed to seize the general inhabitants could also be obscuring challenges skilled by a broad vary of Individuals, particularly these within the backside half of the wealth or earnings spectrum.

And whereas wealth has risen for the much less rich half of the inhabitants in recent times, a lot of the uptick has been locked up in what monetary analysts name “illiquid belongings” — good points in residence costs and stock portfolios — which aren’t simply translated into money to pay for payments and bills which are a lot greater than they have been a number of years in the past.

Though the bottom 50 percent holds solely a 1 % share of all monetary market wealth, six in 10 adults report proudly owning some quantity of inventory. A broad vary of Individuals could also be annoyed by the inaccessibility of this illiquid wealth, stated Daniel Sullivan, analysis director on the JPMorganChase Institute, which tracks the funds of thousands and thousands of U.S. checking account holders.

“‘Huge residence fairness good points, and my 401(okay) is manner up, however I can’t contact that, both!’” Mr. Sullivan defined, channeling the strain many individuals really feel.

Regardless of the expansion in total wealth, financial confidence amongst American households has not returned to the place it was earlier than the pandemic. That was the case even earlier than shopper sentiment readings — together with the inventory market — have been dampened by the prospect of an inflationary international commerce battle from President Trump’s tariff marketing campaign. However what can be putting within the information is the growing hole in perceptions alongside earnings traces.

Over the previous 4 years, the College of Michigan’s month-to-month survey of shopper sentiment has proven these within the backside two-thirds of earnings to be deeply pessimistic in regards to the economic system — with rock-bottom scores extra widespread in periods of deep recession, together with the 2008 monetary disaster.

In distinction, sentiment among the many prime third of earners not too long ago rebounded after falling from prepandemic ranges.

“Greater-income individuals drive most of mixture spending,” stated Joanne Hsu, an economist and director of the Michigan survey. “They have been on an upward surge of sentiment between 2022 and 2024, and that’s according to their sturdy spending.”

A part of the disconnect might stem from the tendency amongst economists to trace earnings progress primarily by proportion change somewhat than greenback quantities.

Even when inflation was peaking round 9 % and diluting earnings development, Ms. Hsu defined, “a ten % increase to center and particularly greater incomes is cash that feels actual, like you are able to do one thing with it.”

For somebody making $100,000, which means a $10,000 increase. However a ten % enhance on the backside, maybe to an hourly wage of $16.50 from $15, “means you’re nonetheless residing hand-to-mouth,” she added.

In a recent report, Matt Bruenig, the president of the Folks’s Coverage Venture, a liberal assume tank, evaluated the long-running query in U.S. economics of what number of adults live paycheck to paycheck — a time period plagued, he stated, by “inherent ambiguities.”

Drawing on data from the Survey of Family Economics and Decisionmaking, performed yearly by the Federal Reserve Board, Mr. Bruenig famous that “if we outline somebody as residing paycheck to paycheck in the event that they both say they don’t have three months of emergency financial savings or say they can not afford a $2,000 emergency expense,” then 59 % of American adults are “residing paycheck to paycheck.”

‘Loss Aversion’

One drive behind the lingering dour temper could also be extra psychic, extra intangible, than financial information can simply detect, in response to Chris Wheat, the president of the JPMorganChase Institute.

Much less rich Individuals, each center and dealing class, he stated, should be reckoning with “the psychological impact” of the volatility led to by the pandemic and postpandemic interval of 2020 to 2023, which introduced each constructive and adverse swings in money financial savings.

Lump sums of direct federal help in 2020 and 2021 helped tens of thousands and thousands of households pay down money owed, save extra of their earnings and get a short style of what residing requirements have been like properly above their typical earnings.

That help, as anticipated, ended. And there was a harsh comedown from these highs.

Inflation-adjusted earnings and inflation-adjusted spending for the standard family fell considerably from 2021 to 2023, analysis from the JPMorganChase Institute discovered, utilizing information from greater than eight million checking account holders. In essence, buying energy decreased.

Throughout the identical interval, checking account balances remained in a traditionally wholesome place throughout all earnings cohorts. But money financial savings have fallen ever since peaking in 2021.

Quite a lot of items and providers have turn out to be dearer, “however individuals’s spending habits didn’t change,” Mr. Wheat stated.

When monetary gravity resumed, lower- and middle-income households that had obtained help have been compelled to renew relying totally on their labor earnings to cowl bills.

That, Mr. Wheat stated, seems to have prompted a critical case of what each psychologists and economists name “loss aversion” — the human proneness to extra painfully really feel what has been misplaced than to note what has been gained. The earnings development that almost all staff captured, to average hourly earnings of $31 in January 2025 from $23 in January 2019, didn’t really feel nearly as good as inflation felt unhealthy.

Most economists imagine it was applicable for the extraordinary help of 2020-21 that enlarged family financial institution accounts to finish. And a few argued that it ought to have ended sooner.

However being nudged again into tighter budgeting once more, after gaining extra monetary respiratory room, nevertheless briefly, will be “irritating,” Mr. Wheat famous.

Home-Wealthy(er), Money-Skinny(ner)

Residence costs have boomed since 2020. And about half the web price of the much less rich 50 % is in actual property. However the main increase in residence costs skilled by house owners on this half of the inhabitants has usually not been felt.

For one, the next residence appraisal can not cowl greater grocery payments. And with rates of interest excessive and housing scarce, it’s usually infeasible to purchase a primary residence or transfer to a different one.

That, too, might be suppressing financial sentiment amongst these with fewer monetary sources of their household, Ms. Hsu of the College of Michigan stated.

The homeownership price for adults beneath 35, which peaked in 1980 at 50 %, has fallen to 30 %. Estimates from economists at the National Association of Home Builders in 2024 indicated that about half of American households could not afford a $250,000 home and that a big majority couldn’t afford a median-priced residence, now $419,000.

The state of the housing market — largely frozen for about three years — could also be dimming the financial outlook of even higher-income households. A big crop of householders over the previous couple of years have been trying to transfer, for household or work. Rationally, they cherish their low cost, fixed-rate mortgages from the period of decrease rates of interest, and catch sticker shock on the potential month-to-month fee for the same residence at current charges and costs.

One fascinating divot within the broader private finance panorama, nevertheless, is that elevated rates of interest — which have a dampening impact on industries like housing — have given a major personal income boost to millions of households, if solely those who have a capability to save lots of (after taxes and bills).

Analysis groups at massive U.S. banks are discovering that these savers are allocating a higher proportion of their money balances to high-yield financial savings accounts that earn extra curiosity, a direct results of greater rates of interest. Personal interest income hit a record excessive of $2.1 trillion in January.

So for high-income households, whole money reserves are most definitely a lot greater even when checking account balances are down, a report from the JPMorganChase Institute notes.

For lower-income checking account holders, “it’s not darkish, however it’s not fairly as rosy,” Mr. Sullivan concluded.

The Shadow of Tariffs

Traditionally, shopper sentiment tends to enhance after an inflation shock, or a recession, with the passage of time throughout financial expansions. It offers households an opportunity to regulate to new costs, or a brand new job market, and transfer ahead.

However a big and various group of economists and buyers are arguing that the zigzagging nature of Mr. Trump’s tariff marketing campaign is needlessly including inflation hazard and development uncertainty to the comparatively steady path that the economic system was on earlier than he re-entered workplace.

The monetary market sell-off this previous month and up to date plummets in sentiment have “been pushed by coverage uncertainty largely stemming from tariffs and tariff threats,” stated David Lefkowitz, head of U.S. equities at UBS World Wealth Administration.

The president and his advisers, nevertheless, have introduced any potential recession, or uptick in shopper inflation that may result from their policies, as a worth that will have to be paid for the economic system to emerge stronger.

Perception in Mr. Trump’s capacity to steer the economic system performed a key half in his election victory. And he promised to decrease costs and ease the price of residing upon getting into workplace. However public approval of his dealing with of the economic system is simply 39 %, with simply 32 % of respondents approving of his approach to the cost of living, in response to Reuters/Ipsos polling.

Monetary forecasters at main Wall Avenue companies have, for his or her half, taken their beforehand low recession likelihood scores and raised them significantly.

However a number of analysts stay centered much less on recession calls than on attempting to make sense of why so many individuals are feeling down about their financial lives.

Owen Davis, a labor economist and analysis fellow at the Siegel Family Endowment — a nonprofit that funds training and work drive analysis — believes that questions of financial dissatisfaction and the fixed deliberation in recent times over whether or not the U.S. economic system is, or isn’t, heading right into a recession “usually get lumped collectively” in unhelpful methods.

“We want to have the ability to have two completely different conversations in regards to the economic system,” Mr. Davis argues — one in regards to the total dimension, steadiness and course of “the ship,” and one other about its high quality.

“We want to have the ability to distinguish between the query of whether or not the ship is sinking,” he stated, “and the query of whether or not the lodging on the ship are sufficient.”

RELATED POSTS

View all