This holiday season, Christina Beck, an administrative director, is being cautious with her spending. The high cost of food and her mortgage are prompting her to keep her holiday spending in check. On the other hand, her best friend Kristin Aitchison, who works for a senior living home, loves to indulge in gift-giving during the holidays, despite her initial plans to keep it small.

Various factors, such as rising inflation, resumed federal student loan payments, and higher interest rates, are leading to increased caution in holiday spending for many people.

Despite these concerns, consumer spending has remained strong throughout the year. However, the big question for retailers now is whether this trend will continue into the holiday season or if consumers will opt to cut back on their spending.

Forecasts for holiday sales are unclear. While the National Retail Federation expects a 3 to 4 percent increase in holiday sales compared to last year, a survey by the Conference Board indicates that consumers plan to spend slightly less on holiday-related items this year.

Early indicators, such as Amazon’s Prime Day in October, showed a slight increase in spending. However, retail sales saw a 0.1 percent drop in October, the first decline since March. Executives at Walmart also noted a weakening in consumer spending in the last two weeks of October, indicating that consumers may be waiting for sales.

Although the retail sales decline was smaller than expected, it still reflects a sense of caution among consumers. Despite this, holiday sales are anticipated to be reasonable, although not as strong as the exceptional seasons in 2020 and 2021.

While higher-income shoppers have accumulated savings during and after the pandemic, those with lower incomes have depleted their resources to a greater extent. Additionally, higher interest rates may deter shoppers from using credit cards for holiday shopping, impacting their ability to splurge on gifts this year.

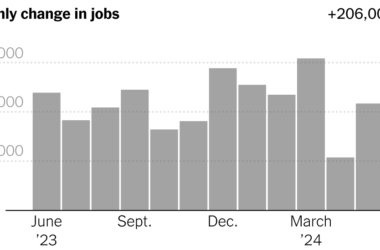

The job market and wage gains have been supporting consumer spending throughout the year. However, signs of a slowdown are emerging, with slowing wage growth and rising unemployment rates. Consumers are also feeling the financial strain from the resumption of student loan payments.

Many consumers are adjusting their holiday spending plans in response to the financial pressures they are facing. Some have decided to reduce their holiday spending due to the resumption of student loan payments, while others are cutting back on their gift lists and spending. Deals and discounts are expected to attract a significant portion of consumers who are looking for ways to save on their holiday purchases.

Overall, the holiday season is characterized by a range of approaches to spending, from careful planning and budgeting to extravagant and spontaneous shopping. The impact of these varying consumer sentiments on holiday sales remains to be seen.