Federal Reserve officials are debating whether to raise interest rates to cool the economy and ensure that rapid inflation diminishes. The minutes from their meeting earlier this month outlined the discussion. According to the minutes from the central bank’s Oct. 31-Nov. 1 meeting, further tightening of monetary policy would be appropriate if progress toward the committee’s inflation objective was unsatisfactory.

Fed officials are awaiting data in the coming months to clarify the extent to which the disinflation process continues. They decided to leave interest rates unchanged in a range of 5.25 to 5.5 percent at their recent gathering, allowing more time to assess the impact of their significant rate adjustments on demand.

Wall Street is closely monitoring the Fed’s next steps. There was an expectation of one more rate move in 2023, but investors believe there is little chance of a rate increase at the final meeting of the year. The minutes suggest officials plan to monitor the economy over the span of “months,” potentially reinforcing expectations of an extended pause. Fed watchers are trying to determine whether officials have finished raising interest rates and, if so, when they might begin cutting them.

Policymakers will release new economic forecasts at the conclusion of their December meeting, potentially providing important clues about the future. If market pricing suggests Wall Street expects rate cuts in the first half of 2024, the possibility of further rate hikes may remain on the table if officials indicate so during the December economic projections.

The minutes from the Fed’s November gathering expanded on policymakers’ outlook. While they aim to cool the economy enough to bring inflation back to their 2 percent goal in a timely manner, they also want to avoid over-tightening and risking a recession. Most participants still see upside risks to inflation, even though inflation fell to 3.2 percent in October from a peak above 9 percent in summer 2022.

The concern is that it may be challenging to fully control inflation. Fed officials define their inflation target using a related measure, the Personal Consumption Expenditures index. They have been closely monitoring signs of strength in the job market and the economy to determine if inflation is likely to come fully under control.

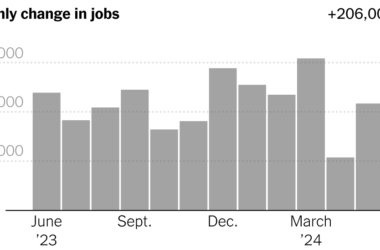

Further positive news since the last meeting shows that employers are hiring at a slower pace. The minutes suggested that policymakers are watching for signs that labor markets were reaching a better balance between demand and supply.