March 28, 2024 | by Kaju

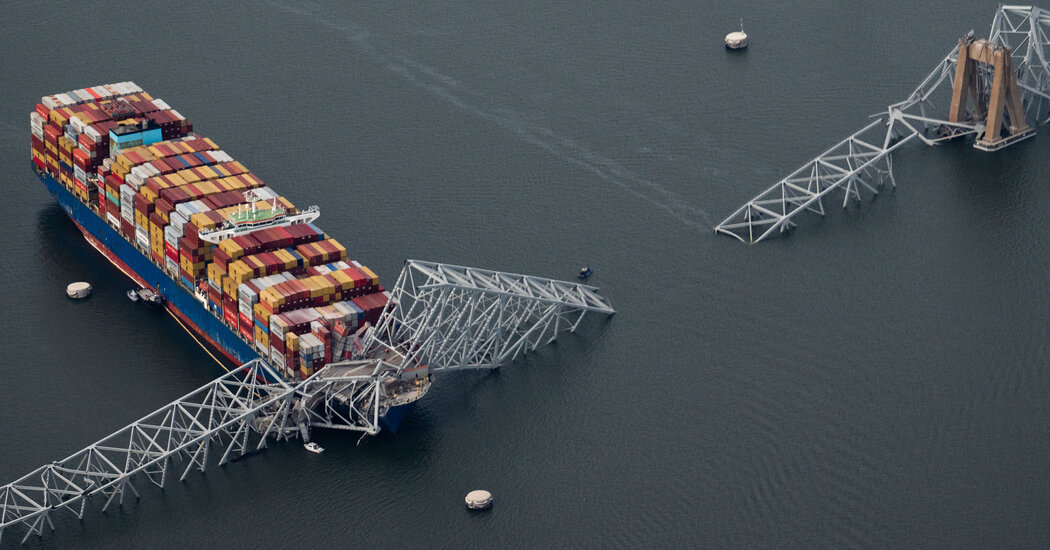

Even earlier than an unlimited container ship rammed a bridge in Baltimore within the early hours of Tuesday, sending the span hurtling into the Patapsco River, and halting cargo visitors at a serious American port, there was ample cause to fret concerning the troubles dogging the worldwide provide chain.

Between swirling geopolitical winds, the variables of local weather change and continued disruptions ensuing from the pandemic, the dangers of relying on ships to hold items across the planet had been already conspicuous. The pitfalls of counting on factories throughout oceans to provide on a regular basis gadgets like clothes and demanding wares like medical units had been directly vivid and unrelenting.

Off Yemen, Houthi rebels have been firing missiles at container ships in what they are saying is a present of solidarity with Palestinians within the Gaza Strip. That has pressured ocean carriers to largely bypass the Suez Canal, the important waterway linking Asia to Europe, and as an alternative circumnavigate Africa — including days and weeks to journeys, whereas forcing vessels to burn extra gasoline.

In Central America, a dearth of rainfall, linked to local weather change, has restricted passage by the Panama Canal. That has impeded an important hyperlink between the Atlantic and the Pacific, delaying shipments to the East Coast of the US from Asia.

These episodes have performed out amid reminiscences of one other latest blow to commerce: the closing of the Suez Canal three years in the past, when the container ship Ever Given hit the aspect of the waterway and bought caught. Whereas the vessel sat, and social media crammed with memes of contemporary life stopped, visitors halted for six days, freezing commerce estimated at $10 billion a day.

Now the world has gained one other visible encapsulation of globalization’s fragility by the abrupt and gorgeous elimination of a serious bridge in an industrial metropolis distinguished by its busy docks.

The Port of Baltimore is smaller than the nation’s largest container terminals — these in Southern California, in Newark, N.J., and in Savannah, Ga. — however it’s a main part of the availability chain for autos, serving because the touchdown zone for vehicles and vehicles arriving from factories in Europe and Asia. It is usually a big embarkation level for exports of American coal.

A lot of these items might be delayed in reaching their final locations, forcing shippers to make alternate plans, and limiting stock. In an age of interconnection, issues in a single spot can rapidly be felt extra extensively.

“The tragic collapse of the Francis Scott Key Bridge goes to place stress on different modes and port options,” stated Jason Eversole, an government at FourKites, a provide chain consultancy. Some cargo that may have gone by Baltimore is prone to wind up in Charleston, S.C.; Norfolk, Va.; or Savannah.

That can enhance demand for trucking and rail companies, whereas making it extra advanced and dear to get items the place they’re purported to go.

“Even as soon as they take away the rubble from the water, visitors within the space shall be impacted as truck drivers change into reluctant to take hundreds out and in of the area with no worth enhance,” Mr. Eversole stated.

Unease now hovers over the availability chain, a topic now not simply the province of wonks and commerce specialists, but additionally a subject of dialog for individuals making an attempt to know why they can not end their kitchen renovation.

There are recent reminiscences of the alarming shortages of medical protecting gear in the course of the first wave of Covid-19, which pressured docs in a few of the wealthiest nations to go with out masks or robes as they attended to sufferers. Households keep in mind not having the ability to order hand sanitizer and scrambling to seek out rest room paper, a beforehand unimaginable prospect.

Most of the worst results of the Nice Provide Chain Disruption have eased significantly or disappeared. The worth of transport a container of products from a manufacturing facility in China to a warehouse in the US multiplied from about $2,500 earlier than the pandemic to 10 instances that on the peak of chaos. These costs have returned to historic norms.

Now not are container ships queued off ports like Los Angeles and Lengthy Seashore, Calif., as they had been when Individuals overwhelmed the system with orders for train bikes and barbecues whereas in quarantine.

However many merchandise stay scarce, partly due to business’s lengthy embrace of just-in-time manufacturing: Reasonably than pay to stash further items in warehouses, corporations have, over the a long time, lower inventories to save lots of prices. They’ve trusted container transport and the online to summon what they want. That has left the world weak to each sudden hit to the motion of products.

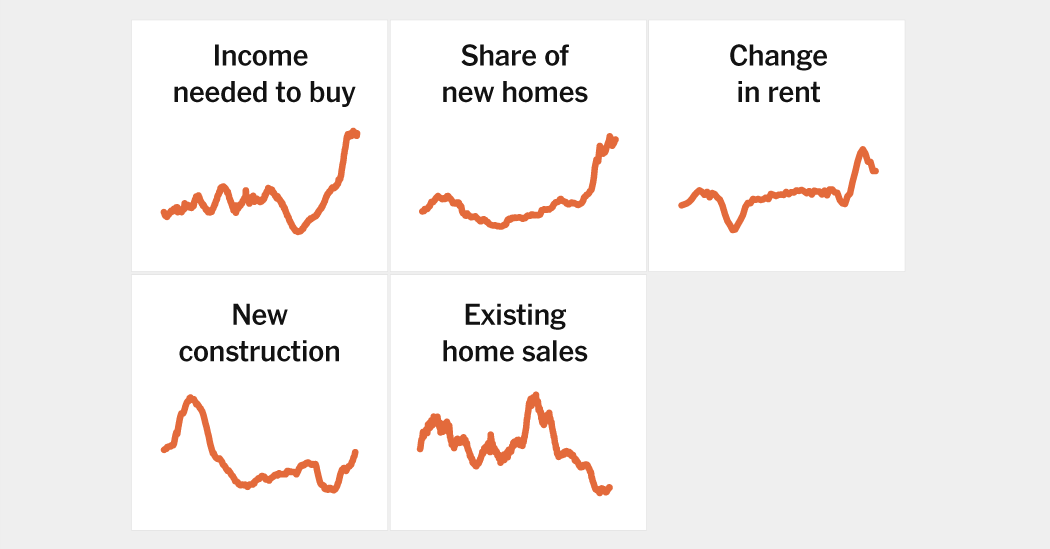

In fast-growing American cities, a housing scarcity that has despatched dwelling costs hovering has perpetuated as a result of contractors nonetheless can’t safe gadgets like electrical switches and water meters, which may take greater than a yr to reach.

“The provision chain remains to be holding up development,” stated Jan Ellingson, an actual property dealer at Keller Williams in Casa Grande, Ariz.

The pandemic chaos assailed the complete system directly, sending truck drivers and dockworkers into lockdown simply as report volumes of imported items landed on American shores. The newest occasion, in Baltimore, might show more cost effective than different latest episodes.

“There’s slack within the system, and it’s significantly better positioned to soak up the sorts of shocks we’re seeing,” stated Phil Levy, a former chief economist on the transport logistics firm Flexport.

He cautioned that it could be flawed to deduce from wayward container ships that globalization itself was flawed.

“Why don’t we make the whole lot in a single place, so we don’t want to fret about transport?” he requested. “As a result of it could be dramatically dearer. We save monumental quantities of cash by letting corporations supply elements the place they’re least expensive.”

Nonetheless, corporations are more and more intent on limiting their publicity to the vulnerabilities of ocean transport and altering geopolitics. Walmart has been shifting manufacturing of manufacturing facility items from China to Mexico. That marketing campaign started with President Donald J. Trump’s imposition of tariffs on imports from China — a commerce battle since superior by the Biden administration.

Different American retailers like Columbia Sportswear are in search of out factories in Central America, whereas Western European corporations are centered on shifting manufacturing nearer to their clients, increasing factories in Jap Europe and Turkey.

Towards these tectonic shifts, the catastrophe in Baltimore might show a momentary problem to the motion of products, or an prolonged one. With provide chains, the results of any single disturbance could be troublesome to anticipate.

A manufacturing facility close to Philadelphia might have virtually all of the a whole lot of elements required to make paint. But one ingredient delayed — maybe caught on a container ship off California, or rendered briefly provide by a weather-related manufacturing facility shutdown on the Gulf of Mexico — could be sufficient to halt manufacturing.

The dearth of a single key half — a pc chip, or a part of its meeting — can drive automakers from South Korea to the American Midwest to mothball completed autos in parking tons, awaiting the lacking piece.

Someplace on earth — possibly shut by, and possibly on the opposite aspect of the world — somebody is ready for a container caught on a vessel penned into Baltimore Harbor.

The wait will now be a bit longer.

RELATED POSTS

View all