Federal Reserve officers left rates of interest unchanged and signaled that they had been cautious about how cussed inflation was proving, paving the best way for an extended interval of excessive borrowing prices.

The Fed held charges regular at 5.3 p.c on Wednesday, leaving them at a greater than two-decade excessive, the place they’ve been set since July. Central bankers reiterated that they wanted “higher confidence” that inflation was coming down earlier than lowering them.

“Readings on inflation have are available above expectations,” Jerome H. Powell, the Fed chair, stated at a information convention after the discharge of the central financial institution’s fee choice.

The Fed stands at an advanced financial juncture. After months of speedy cooling, inflation has proved surprisingly sticky in early 2024. The Fed’s most popular inflation index has made little progress since December, and though it’s down sharply from its 7.1 p.c excessive in 2022, its present 2.7 p.c continues to be effectively above the Fed’s 2 p.c aim. That calls into query how quickly and the way a lot officers will be capable of decrease rates of interest.

“What we’ve stated is that we have to be extra assured” that inflation is coming down sufficiently and sustainably earlier than chopping charges, Mr. Powell stated. “It seems that it’s going to take longer for us to succeed in that time of confidence.”

The Fed raised rates of interest rapidly between early 2022 and the summer season of 2023, hoping to sluggish the economic system by tamping down demand, which might in flip assist to wrestle inflation underneath management. Greater Fed charges trickle by way of monetary markets to push up mortgage, bank card and enterprise mortgage charges, which might cool each consumption and firm expansions over time.

However Fed policymakers stopped elevating charges final yr as a result of inflation had begun to come back down and the economic system gave the impression to be cooling, making them assured that they’d executed sufficient. They’ve held charges regular for six straight conferences, and as lately as March, they’d anticipated to make three rate of interest cuts in 2024. Now, although, inflation’s current endurance has made that look much less doubtless.

Many economists have begun to push again their expectations for when fee reductions will start, and traders now anticipate just one or two this yr. Odds that the Fed is not going to lower charges in any respect this yr have elevated notably over the previous month.

Mr. Powell made it clear on Wednesday that officers nonetheless thought that their subsequent coverage transfer was more likely to be a fee lower and stated {that a} fee improve was “unlikely.” However he demurred when requested whether or not three reductions had been doubtless in 2024.

He laid out pathways wherein the Fed would — or wouldn’t — lower charges. He stated that if inflation got here down or the labor market weakened, borrowing prices may come down.

However, “if we did have a path the place inflation proves extra persistent than anticipated, and the place the labor market stays robust, however inflation is transferring sideways and we’re not gaining higher confidence, effectively, that might be a case wherein it might be applicable to carry off on fee cuts,” Mr. Powell stated.

Traders responded favorably to Mr. Powell’s information convention, doubtless as a result of he prompt that the bar for elevating charges was excessive and that charges may come down in a number of eventualities. Shares rose and bond yields fell as Mr. Powell spoke.

“The massive shock was how reluctant Powell was to speak about fee hikes,” stated Michael Feroli, chief U.S. economist at J.P. Morgan. “He actually appeared to say that the choices are chopping or not chopping.”

Nonetheless, an extended interval of excessive Fed charges can be felt from Wall Road to Foremost Road. Key inventory indexes fell in April as traders got here round to the concept that borrowing prices may stay excessive for longer, and mortgage charges have crept again above 7 p.c, making dwelling shopping for pricier for a lot of want-to-be house owners.

Fed officers are planning to maintain charges excessive for a cause: They wish to make sure to stamp out inflation totally to forestall rapidly rising costs from changing into a extra everlasting a part of America’s economic system.

Policymakers are carefully watching how inflation information form up as they struggle to determine their subsequent steps. Economists nonetheless anticipate that value will increase will begin to decelerate once more within the months to come back, specifically as hire will increase fade from key value measures.

“My expectation is that we’ll, over the course of this yr, see inflation transfer again down,” Mr. Powell stated on Wednesday. However he added that “my confidence in that’s decrease than it was due to the information that we’ve seen.”

Because the Fed tries to evaluate the outlook, officers are more likely to additionally regulate momentum within the broader economic system. Economists usually suppose that when the economic system is sizzling — when firms are hiring quite a bit, shoppers are spending and development is speedy — costs have a tendency to extend extra rapidly.

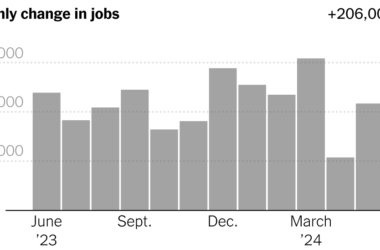

Development and hiring haven’t slowed down as a lot as one may need anticipated given as we speak’s excessive rates of interest. A key measure of wages climbed more rapidly than anticipated this week, and economists at the moment are carefully watching a jobs report scheduled for launch on Friday for any trace that hiring stays strong.

However to date, policymakers have usually been comfy with the economic system’s resilience.

That’s partly as a result of development has been pushed by bettering financial provide: Employers have been hiring because the labor pool grows, as an illustration, partly as a result of immigration has been speedy.

Past that, there are hints that the economic system is starting to chill across the edges. General financial development slowed within the first quarter, although that pullback got here from large shifts in enterprise inventories and worldwide commerce, which frequently swing wildly from one quarter to the subsequent. Small-business confidence is low. Job openings have come down considerably.

Mr. Powell stated Wednesday that he thought larger borrowing prices had been weighing on the economic system.

“We imagine that our coverage stance is in a superb place and is suitable to the present state of affairs — we imagine it’s restrictive,” Mr. Powell stated.

Because the Fed waits to make rate of interest cuts, some economists have begun to warn that the central financial institution’s changes may collide with the political calendar.

Donald J. Trump, the previous president and presumptive Republican nominee, has already prompt that rate of interest cuts this yr can be a political transfer meant to assist President Biden’s re-election bid by pumping up the economic system. Some economists suppose that chopping within the weeks main as much as the election — both in September or November — may put the Fed in an uncomfortable place, drawing additional ire and probably making the establishment look political.

The Fed is unbiased of the White Home, and its officers have repeatedly stated that they won’t take politics into consideration when setting rates of interest, however will fairly be guided by the information.

Mr. Powell reiterated on Wednesday that the Fed didn’t and wouldn’t bear in mind political concerns in timing its fee strikes.

“Should you go down that highway, the place do you cease? So we’re not on that highway,” Mr. Powell stated. “It simply isn’t a part of our considering.”